Pt

Please note that the Company was placed into Administration on 16 May 2024 and Chad Griffin and Geoff Rowley of FRP Advisory were appointed as Joint Administrators.

The Joint Administrators will be winding-down the Company’s operations following which it will cease trading.

Should you have any queries regarding the administration, you can contact the Joint Administrators on hzmplc@frpadvisory.com.

The Joint Administrators act as agents of the Company and without personal liability.

The Company entered Administration on 16 May 2024. The affairs, business and property of the Company are being managed by the appointed Joint Administrators Chad Griffin and Geoffrey Paul Rowley.

Horizonte is developing its 100% owned Araguaia Nickel Project (Araguaia) as Brazil’s next major ferronickel mine. Araguaia is a Tier 1 mining project with a high-grade scalable resource, located south of the Carajás Mining District in the Pará State, north Brazil. The area has a well-developed infrastructure, including roads, rail, and hydroelectric power as a result of the sustained mining activity in Carajás.

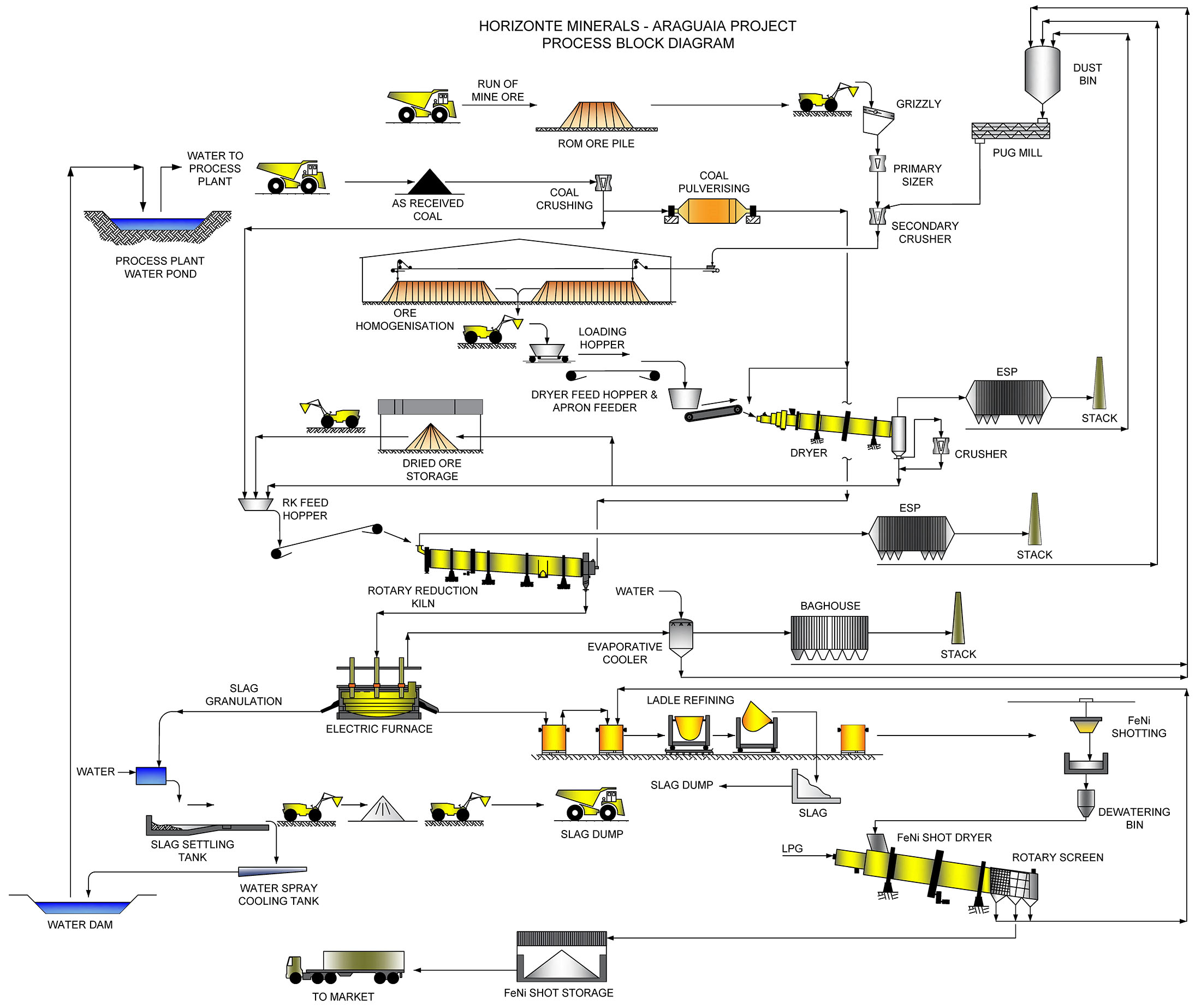

The Feasibility Study (FS) comprises an open pit nickel laterite mining operation that delivers ore from a number of pits to a central rotary kiln electric furnace (RKEF) metallurgical processing facility. The metallurgical process comprises a single line (RKEF) to extract FeNi from the ore. After an initial ramp-up period, the plant will reach a full capacity of approximately 900,000 tonnes of dry ore feed per year to produce 52,000 tonnes of ferronickel, in turn containing 14,500 tonnes of nickel per year. The FeNi product will be transported by road to the port of Vila do Conde in the north of the State for sale to overseas customers.

The initial 28 year mine life of the FS design generates free cash flows after taxation of US$1.6 billion, returning an IRR of over 20% on an initial capital cost of $US443 million, with predicted sufficient Mineral Resources to extend the mine life well beyond the 28 year period or to increase capacity.

The project has been designed to allow for a second RKEF process plant, which would double Araguaia’s output of FeNi.

The Feasibility Study confirms Araguaia as a Tier 1 project with a large high-grade scalable resource, a long mine life and a low-cost source of ferronickel for the stainless-steel industry. Included within the Study is the option for future construction of a second process line which would double Araguaia’s production capacity from 14,500 t/a nickel up to 29,000 t/a nickel.

The Stage 2 expansion gives a 26-year mine life, generating cash flows after taxation of US$2.6 billion, with an estimated NPV of US$741 million and an IRR of 23.8% - using the base case nickel price forecast of $14,000/t. The second line will be financed through operational cash flow, meaning upfront capital cost remains at the same level at the FS Stage 1 of US$443 million.

The Project has two principal mining centres; Araguaia Nickel South (‘ANS’) and Araguaia Nickel North (‘ANN’). ANS hosts seven deposits: Pequizeiro, Baião, Pequizeiro West, Jacutinga, Vila Oito East, Vila Oito West and Vila Oito, while ANN hosts the Vale do Sonhos deposit.

A number of phases of diamond drilling has been completed across the ANP (Araguaia Nickel Project) commencing in 2010. Drilling at ANS has been undertaken by HZM and Teck, with drilling at ANN by Xstrata. HZM has been active on the ANS project since the initial discovery in 2010. Then HZM successfully completed the acquisition and integration of the Teck and Xstrata project areas, and has been the sole project operator since 2015. A total of 75,250 m of diamond drilling has been completed across 2,627 holes for the Project.

Snowden Mining and Industry Consultants (Snowden) were commissioned by Horizonte to produce Mineral Reserves, Mineral Resources and the Mining sections of the FS for the Project.

Mineral Resources reported for the Project deposits, were prepared by an Independent Qualified Person as defined in NI 43-101.

Mineral Resource estimates for the nickel laterite deposits under consideration for the FS are shown in the table below. The Measured Mineral Resource estimated at a cut-off grade of 0.90% Ni, is 18 Mt at a grade of 1.44% Ni. The Indicated Mineral Resource is 101 Mt at a grade of 1.25% Ni. This gives a combined Mineral Resource of 119 Mt at a grade of 1.27% Ni for Measured and Indicated Mineral Resources at a cut-off grade of 0.90% Ni (inclusive of Mineral Reserves).

| Araguaia | Category | Material type | Tonnage (kt) | Contained Ni metal (kt) | Ni | Co | Fe | MgO | SiO2 | Al2O3 | Cr2O3 |

| (%) | (%) | (%) | (%) | (%) | (%) | (%) | |||||

| Subtotal | Measured | Limonite | 1,232 | 15 | 1.20 | 0.15 | 37.43 | 2.00 | 17.15 | 11.07 | 2.98 |

| Transition | 6,645 | 116 | 1.75 | 0.07 | 18.89 | 10.20 | 42.06 | 6.59 | 1.29 | ||

| Saprolite | 10,291 | 130 | 1.27 | 0.03 | 12.03 | 24.08 | 41.24 | 3.95 | 0.87 | ||

| Total | Measured | All | 18,168 | 261 | 1.44 | 0.05 | 16.26 | 17.51 | 39.91 | 5.40 | 1.17 |

| Subtotal | Indicated | Limonite | 19,244 | 216 | 1.12 | 0.12 | 36.22 | 2.40 | 20.46 | 9.61 | 2.65 |

| Transition | 30,917 | 439 | 1.42 | 0.07 | 21.38 | 11.26 | 38.95 | 5.37 | 1.51 | ||

| Saprolite | 51,008 | 610 | 1.18 | 0.03 | 11.83 | 25.79 | 40.59 | 3.16 | 0.85 | ||

| Total | Indicated | All | 101,169 | 1,264 | 1.25 | 0.06 | 19.39 | 16.90 | 36.26 | 5.06 | 1.39 |

| Total | Measured + Indicated | All | 119,337 | 1,525 | 1.27 | 0.06 | 18.91 | 16.99 | 36.81 | 5.11 | 1.36 |

| Subtotal | Inferred | Limonite | 2,751 | 30 | 1.08 | 0.10 | 34.92 | 3.04 | 22.84 | 9.23 | 2.50 |

| Transition | 4,771 | 62 | 1.30 | 0.07 | 21.23 | 11.04 | 39.09 | 5.62 | 1.40 | ||

| Saprolite | 5,398 | 62 | 1.15 | 0.03 | 11.80 | 24.36 | 41.81 | 3.69 | 0.82 | ||

| Total | Inferred | All | 12,920 | 154 | 1.19 | 0.06 | 20.21 | 14.90 | 36.77 | 5.58 | 1.39 |

Notes:

The Mineral Reserve was estimated by Snowden in accordance with CIM (2014) and JORC (2012) guidelines.

All economic Indicated Resources within the pit designs were classified as Probable Reserves and all Measured Resources at Pequizeiro (ANS) were classified as Proved Reserves (this classification was tested and supported by the trial mining programme completed in this pit in 2017). Measured Resources at Vale dos Sonhos (ANN) were classified as Probable Reserves. A summary is provided in the table below. The Mineral Reserve of 27.2 Mt gives a life of mine of 28 years based on the annual ore throughput to the RKEF plant of 900,000 t/a.

Open pit Mineral Reserves reported as of October 2018

| Category | Ore (Mt) | Ni (%) | Fe (%) | SiO2:MgO | Al2O3 (%) |

| Proven | 7.33 | 1.72 | 16.01 | 3.01 | 6.00 |

| Probable | 19.96 | 1.68 | 17.57 | 2.36 | 4.56 |

| Total | 27.29 | 1.69 | 17.15 | 2.52 | 4.94 |

Araguaia will use an open pit mining method, transporting its nickel-ore to a central processing plant. The open pits will be shallow, with a maximum depth of 30m and no blasting is required. Top soil will be separately stockpiled and mined areas will be rehabilitated.

The annual mining rate peaks at 3.5 Mt/a between production years 2 and 7 before dropping down to 3.0 Mt/a for the remainder of the Project.

The mine supplies high nickel grades in the early mine life, reaching 2% in production year 2. The Ni grade is above 1.8% for the majority of the first 10 years of production and reduces to average approximately 1.6% Ni for the remaining mine life.

As part of the FS a trial excavation programme has been successfully completed, this included mining 27,000 tonnes of material with all technical objectives met.

The Araguaia Nickel Project will utilise a low risk proven process technology called the Rotary Kiln Electric furnace (RKEF) to produce a high-grade ferronickel product to sell into for the stainless-steel market. Today the RKEF process is in operation in over 40 mines around the world and accounts for a significant portion of the nickel produced annually.

Ausenco Pty Ltd was commissioned by Horizonte to undertake the engineering of the process plant for the FS.

Detailed metallurgical test work has been completed on the ANP ore. This included initial lab and bench scale test work leading to a fully integrated pilot campaign which demonstrated the full RKEF flowsheet, on a representative bulk sample of 220 tonnes (wet) over a 10-day period operating 24 hours per day.

The key steps in the RKEF flowsheet are summarised below and can been seen in the video.

The FS base case financial model was developed using a flat nickel price of $14,000/t Ni. Two other cases were prepared; one using a market consensus price of US$16,800/t Ni and other used the Wood Mackenzie long term incentive forecast of US$26,450/t Ni. These two additional price forecasts represent upside scenarios.

The FS demonstrates robust economics for a 28 year mine, producing ~14,500 tonnes per annum nickel.

A discount rate of 8% was used for NPV calculations.

Project economics (post taxation)

| Item | Unit | Nickel price basis (US$/t Ni) | ||

| Base (14,000) |

Consensus (16,800) |

Wood Mackenzie (26,450) | ||

| Net cash flow | US$M | 1,572 | 2,582 | 6,060 |

| NPV8 | US$M | 401 | 740 | 1,906 |

| IRR | % | 20.1 | 28.1 | 50.4 |

| Breakeven (NPV8) Ni price | US$/t | 10,766 | 10,766 | 10,766 |

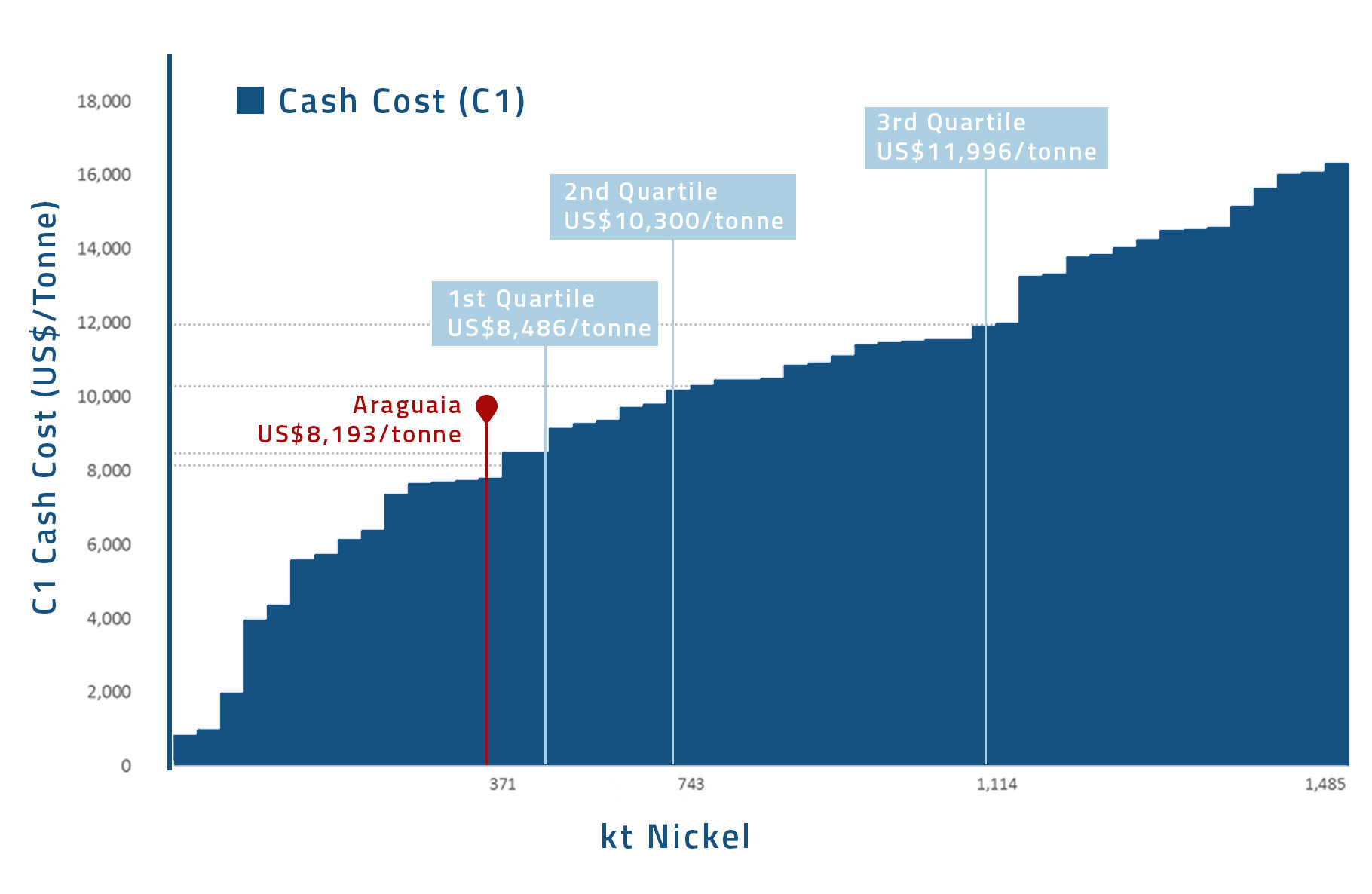

| C1 Cost (Brook Hunt) | US$/t | 8,193 | 8,193 | 8,193 |

| Production year payback | years | 4.2 | 3.3 | 1.8 |

| LOM Ni recovered | kt | 426 | 426 | 426 |

| LOM Fe recovered | kt | 995 | 995 | 995 |

| Average Ni production at 0.9 Mt/a ore 1 | kt/a | 14.5 | 14.5 | 14.5 |

| Average Fe production at 0.9 Mt/a ore | kt/a | 32 | 32 | 32 |

| Total revenue | US$M | 5,970 | 7,164 | 11,449 |

| Total costs | US$M | 3,811 | 3,995 | 4,657 |

| Operating cash flow | US$M | 2,159 | 3,169 | 6,792 |

The Feasibility Study confirms Araguaia as a Tier 1 project with a large high-grade scalable resource, a long mine life and a low-cost source of ferronickel for the stainless-steel industry. Within the Study, includes the option for future construction of a second process line with would double Araguaia’s production capacity from 14,500 t/a nickel up to 29,000 t/a nickel.

The Stage 2 expansion gives a 26-year mine life generating cash flows after taxation of US$2.6 billion with an estimated NPV of US$741 million and an IRR of 23.8%, using the base case nickel price forecast of $14,000/t. The second line will be financed through operational cash flow, meaning upfront capital cost remains at the same level at the FS Stage 1 of US$443 million.

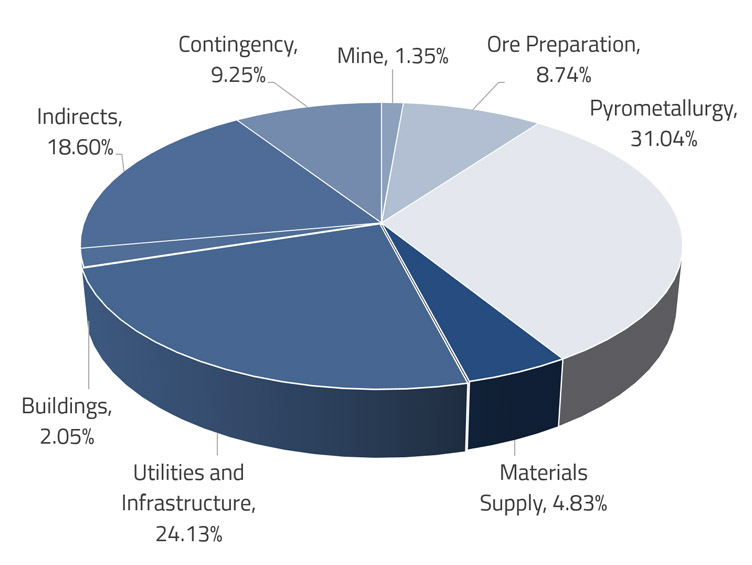

An initial capital cost of $US443 million is estimated for Araguaia.

|

Area name |

Costs (US$‘000) |

|

Mine |

6,003 |

|

Ore Preparation |

38,731 |

|

Pyrometallurgy |

137,518 |

|

Materials Supply |

21,413 |

|

Utilities and Infrastructure |

106,918 |

|

Buildings |

9,095 |

|

Indirects |

82,409 |

|

Contingency |

40,989 |

|

Total |

443,076 |

The capital cost estimate was built to an Association for the Advancement of Cost Engineering (AACE class 3) level which delivers an accuracy range between -10% and +15% of the final project cost (excluding contingency) with a base date of October 2018. All amounts expressed are in US dollars.

Tier 1 Project: Low Cost & High Grade

Araguaia positioned in the lower quartile for nickel laterite projects on global C1 (Brooke Hunt) Cash Cost

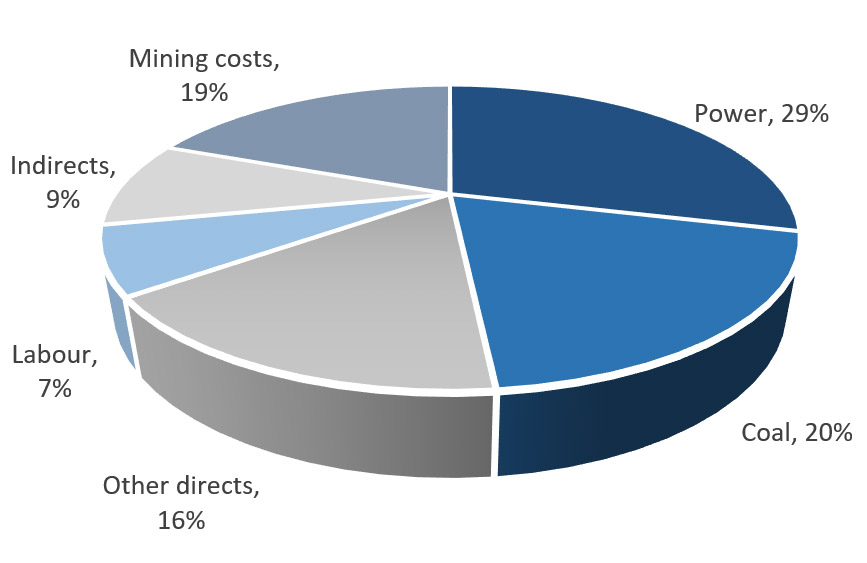

The mining and operating cost estimate (opex) was calculated for an operation producing 14,749t Ni per annum and is set out as an annual total and US$/t Ni in Table below, calculated as an average over the LOM.

| Description | US$/t nickel |

| Process Plant | |

| Directs | |

| Power | $2,410 |

| Coal | $1,620 |

| Other directs | $1,348 |

| Labour | $588 |

| Subtotal – Direct costs | $5,966 |

| Indirects | $772 |

| Mining costs | $1,584 |

| Total costs | $8,322 |

The Araguaia project is one of the few development-ready nickel laterite projects globally. The FS sets out key environmental and social aspects of the project. Horizonte has successfully obtained the Construction Licence in January of 2019 and the water permit for full-scale operation at Araguaia.

Environmental Resource Management (“ERM”) together with Integratio (social and land) and DBO Environmental Engineering (fauna) were retained to undertake the work for the Construction Licence covering both Environmental and Social streams. ERM and partners, across multiple disciplines, conducted a number of new studies in 2017 and 2018 including, but not limited to:

Brandt Consultants were hired to undertake new environmental impact assessments and advance permits for the Transmission Line and the Araguaia North deposit (acquired from Glencore in 2015).

The Company has conducted studies to both Brazilian and International Standards, applying IFC Performance Standards and Equator Principles to our work streams. Independent consultant reviews are taking place on international standards as part of the finance package Due Diligence work underway for Araguaia.