Pt

Please note that the Company was placed into Administration on 16 May 2024 and Chad Griffin and Geoff Rowley of FRP Advisory were appointed as Joint Administrators.

The Joint Administrators will be winding-down the Company’s operations following which it will cease trading.

Should you have any queries regarding the administration, you can contact the Joint Administrators on hzmplc@frpadvisory.com.

The Joint Administrators act as agents of the Company and without personal liability.

The Company entered Administration on 16 May 2024. The affairs, business and property of the Company are being managed by the appointed Joint Administrators Chad Griffin and Geoffrey Paul Rowley.

The Group owns 100% of the Vermelho Nickel-Cobalt project. Vermelho is a high-grade scalable resource, located in the Carajás Mining District in the Pará State, north east Brazil. The area has a well-developed infrastructure, including roads, rail, and hydroelectric power as a result of the sustained mining activity in Carajás.

Vermelho was first developed by Vale (formerly CVRD) with the objective of becoming their principal nickel-cobalt operation. Extensive work was undertaken on the Project at Scoping (Preliminary Economic Assessment or PEA), PFS and Feasibility Study (FS) stages. This included drilling and pitting programs totalling 152,000 m, batch and full-scale pilot testwork, in addition to detailed engineering studies. The Project was subsequently taken through a Feasibility Study with Vale reporting a positive development decision in 2005. The Project was subsequently placed on hold following Vale’s purchase of Canadian nickel miner, Inco, in late 2005.

In December 2017, Horizonte reached an agreement with Vale SA to acquire 100% of the advanced nickel cobalt project. This acquisition transformed Horizonte into a multi asset company with two large projects located in an established mining district. The cobalt resource gave Horizonte exposure and access to an additional commodity stream in light of the burgeoning Battery Metal and Electric Vehicle market.

Horizonte released a Pre-Feasibility Study (PFS), in late 2019, looking at a smaller operational scenario with lower capital costs. The study confirmed Vermelho as a Tier 1 project with a large high-grade resource, a long mine life, and a low-cost source of nickel sulphate for the battery industry. This PFS was undertaken to suit the chosen scale and strategy targeted by Horizonte and to take advantage of the latest advancements in processing technology.

The Vermelho PFS comprises a planned open pit nickel laterite mining operation that covers a number of different pits. The hydro-metallurgical process comprises a beneficiation plant where ore is upgraded prior to being fed to a centralised High-Pressure Acid Leach (HPAL) and refining Plant which produces the sulphates. The Project will mine a 141.3 million tonne (Mt) Probable Mineral Reserve to produce 924kt of nickel contained in nickel sulphate, 36kt of cobalt contained in cobalt sulphate and 4.48 Mt of a saleable by-product, kieserite (a form of fertiliser) over an initially projected 38-year life. At full production capacity the Project is expected to produce an average of 25,000 tonnes of nickel and 1,250 tonnes of cobalt per annum, utilising the High-Pressure Acid Leach process.

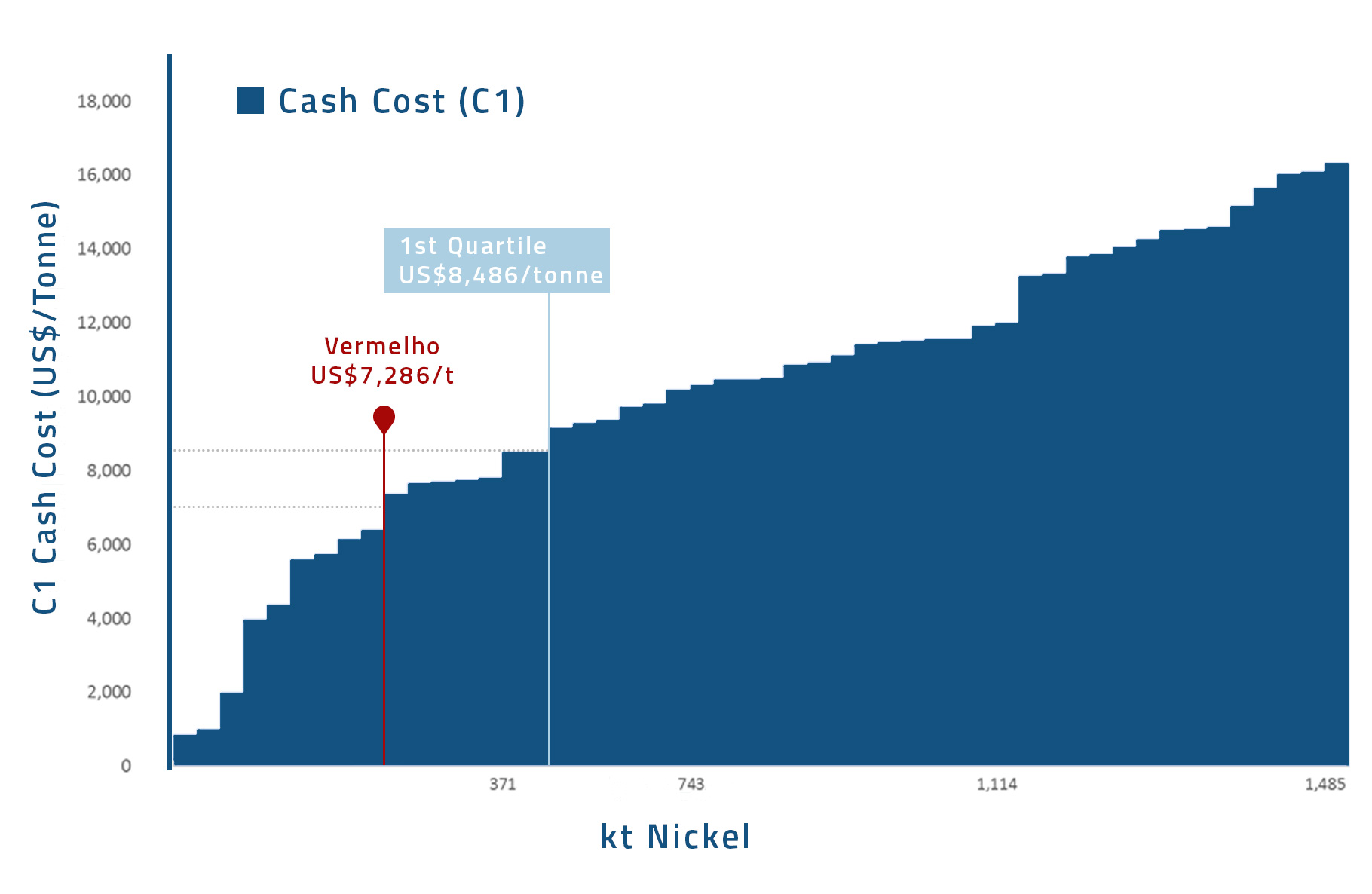

The initial 38 year mine life of the PFS design will generate a free cash flows after taxation of US$7.3 billion, returning an IRR of over 26% on an initial capital cost of $US652 million and C1 cash cost of $8,029/t Ni during life of mine, and $7,286 C1 cash cost in years 1-10 (applying consensus nickel price of $16,400/tonne).

The Vermelho nickel deposits consist of two hills named V1 and V2 (after Vermelho 1 and Vermelho 2), aligned on a northeast-southwest trend, overlying ultramafic bodies. A third ultramafic body, named V3, also located in the same trend, lies on flat terrain, southwest of V2. The ultramafic bodies have had an extensive history of tropical weathering, which has produced a thick profile of nickel-enriched lateritic saprolite at V1 and V2

The Vermelho area was explored in various stages by Companhia Vale do Rio Doce (Vale) from 1974 to 2004 involving approximately 152,000 m of combined drilling and pitting. The drilling grid density was substantially enhanced in 2002 to 2004, and most of the resources were upgraded to the Measured category as defined in JORC (2004) and CIM Definition Standards (2014). Pilot plant metallurgical studies were conducted in Australia focused on the HPAL processing method. A PFS was prepared in 2003, and a Feasibility Study (FS) was completed in August 2004 by GRD-Minproc (2005). This study confirmed the positive economic outcomes obtained in previous studies and showed production capacity of 46,000 tonnes per annum (t/a) of metallic nickel, and 2,500 t/a of metallic cobalt. The project was given construction approval in 2005 later that year Vale elected to place the Project on hold after after it acquired Canadian nickel producer Inco.

Snowden Mining and Industry Consultants (Snowden) were commissioned by Horizonte to produce Mineral Resources and the Mining sections of the PFS for the Project.

Mineral Resources reported for the Project deposits, were prepared by an Independent Qualified Person as defined in NI 43-101. Within the mining licence, at a cut-off grade of 0.7% Ni, a total of 140.8 Mt at a grade of 1.05% Ni and 0.05% Co is defined as a Measured Mineral Resource and a total of 5.0 Mt at a grade of 0.99% Ni and 0.06% Co is defined as an Indicated Mineral Resource. This gives a combined tonnage of 145.7 Mt at a grade of 1.05% Ni and 0.05% Co for Measured and Indicated Mineral Resources. A further 3.1 Mt at a grade of 0.96% Ni and 0.04% Co is defined as an Inferred Mineral Resource at a cut-off grade of 0.7% Ni

The Mineral Resource is summarised in Table 1 1.

| Classification | Tonnage (Mt) | Ni % |

Ni metal (kt) | Co % |

Co metal (kt) | Fe2O3 % |

MgO2 % |

SiO2 % |

| Measured | 140.8 | 1.05 | 1,477 | 0.05 | 74.6 | 31.1 | 11.3 | 41.0 |

| Indicated | 5.0 | 0.99 | 49 | 0.06 | 2.8 | 26.3 | 8.6 | 49.0 |

| Measured + Indicated | 145.7 | 1.05 | 1,526 | 0.05 | 77.3 | 30.9 | 11.2 | 41.3 |

| Inferred | 3.1 | 0.96 | 29 | 0.04 | 1.4 | 24.0 | 15.5 | 42.2 |

Notes

Mineral Reserves were prepared for the Project as part of the PFS, using the CIM Definition Standards (2014).

In accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves (as adopted and amended), Mineral Reserves are classified as either “Probable” or “Proven” Mineral Reserves and are based on Indicated and Measured Mineral Resources only in conjunction “estimation of Mineral Resource and Mineral Reserve best practice guidelines” as provided by the CIM. No Mineral Reserves have been estimated using Inferred Mineral Resources.

All economic Measured and Indicated Resources within the pit designs were classified as Probable Reserves. A summary of the Mineral Reserves is provided in Table 15-1.

Open pit Mineral Reserves reported as of October 2018

| Value | Probable |

| Ore (Mt) | 141.3 |

| Ni (%) | 0.91 |

| Co (%) | 0.052 |

| Fe (%) | 23.1 |

| Mg (%) | 3.81 |

| Al (%) | 0.79 |

Notes

Mining at Vermelho is planned to be undertaken with conventional open pit truck and excavator mining methods. Blasting will be necessary for about half of the deposit. Waste overburden will be stripped on 4 m benches, and ore on 2 m benches for additional selectivity.

Reverse circulation (RC) grade control drilling will be completed at 12.5 m x 12.5 m spacing to define the waste/ore/ore type boundary ahead of mining.

Waste will be stored in dumps adjacent to the pits. Ore will be transported to the run of mine (ROM) stockpile near the processing plant or the low-grade stockpiles for later processing

Due to the high rainfall in the wet season, mining (including stockpile rehandling) will be reduced between October and March (as is standard practice in the region). It was assumed that a fleet of Scania G500 8x4 22 m3 heavy tipper will be used as part of the fleet and coarse beneficiation rejects will be used as sheeting, to mitigate trafficability issues.

The mine production schedule targeted a processing rate of 1 Mt/a HPAL feed for the first three years and doubling in capacity thereafter to 2 Mt/a. To facilitate this, ROM feed of approximately 2.25 Mt/a to 4.5 Mt/a is required as well as an acid production capacity of 350 kt/a to 700 kt/a.

The annual mining rate starts at 8 Mt/a and peaks at 12 Mt/a between production years 5 and 11.

The mine supplies higher grade ore in the early mine life to the HPAL circuit, reaching 2% Ni and 0.1% Co in the first four production years. The HPAL feed grade (after beneficiation) is above 1.5% Ni and 0.08% Co for the majority of the first 17 years of production and reduces over the remaining LOM as feed is sourced from large lower grade stockpiles that were developed in the early years and are depleted in the later years.

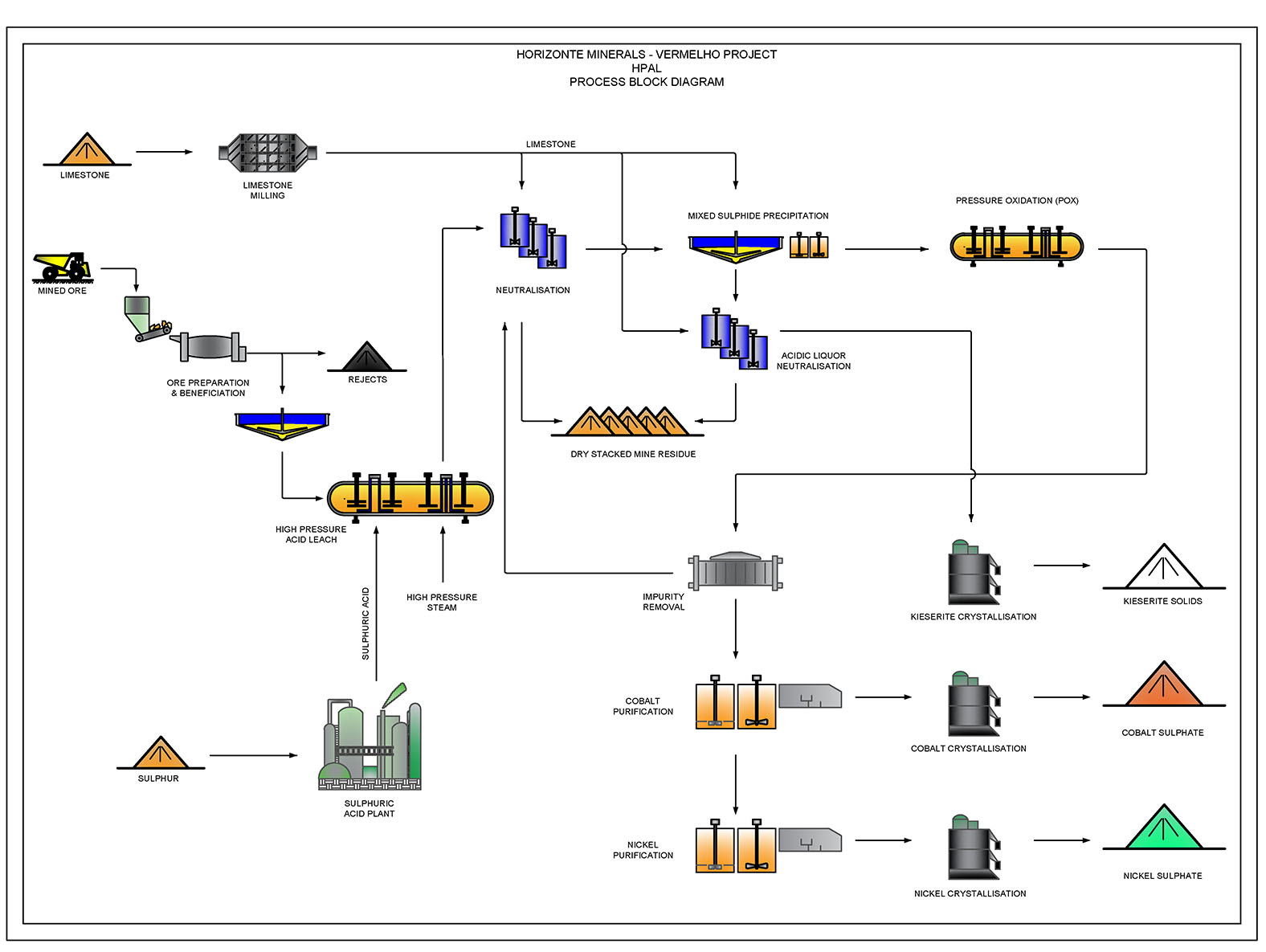

The process selected for the Project is the production of nickel and cobalt sulphate product via High Pressure Acid Leaching (HPAL), mixed sulphide precipitate (MSP), pressure oxidation leaching (POX), cobalt solvent extraction (CoSX) and crystallization. Prior to the HPAL process barren free silica is removed from the ore via a beneficiation which involves crushing, scrubbing and washing, separation by screening and by hydrocyclones.

The plant will be constructed in two phases, with an initial capacity of 1 Mt per annum (Mt/a) autoclave feed, then after three years of production, a second process train will be constructed effectively doubling the autoclave feed rate to 2 Mt/a. The Stage 1 plant and project infrastructure will be constructed over a 31-month period, and stage 2, effectively duplicating the stage 1 capacity completed after year 3 of production.

The process plant has been designed to process 4.34 Mt/a of ROM ore at 1.07% Ni. Of this total feed, 2.34 Mt/a is rejected as coarse, low grade siliceous waste from the beneficiation plant. The beneficiated 2 Mt/a product at 1.85% Ni is fed to the HPAL processing plant as an upgraded feed (1 Mt/a per train). A common refining circuit treats the MSP produced from each train via POX, CoSX and crystallization. The crushing circuit was designed for 75% availability and all downstream process plant was designed for 85% availability. The proposed process plant has been designed to recover 94.4% and 94.9% of the nickel and cobalt from the HPAL feed at an acid consumption of 347 kg/t. The nickel and cobalt sulphate products are of high purity suitable for sale directly into the battery market.

Extensive metallurgical testwork and process design was undertaken on the Project by the former owner, Vale, at scoping, prefeasibility and feasibility stages, included drilling and pitting programs totalling 152,000 m, variability batch testwork, full-scale pilot testwork and detailed engineering studies. A five-year, exhaustive, metallurgical testwork and pilot plant program demonstrated that a high degree of mined ore upgrade using a simple beneficiation processes was possible. The resultant feed delivered 96% average leaching extraction for nickel and cobalt via HPAL technology.

Additional testwork has been completed by the current Project owner, HZM, during 2018 and 2019. This testwork on selected samples from Vermelho validated the potential to produce high-grade sulphate products using the HPAL process.

The 6,000 plus samples totalling over 160t used for PFS and Final Feasibility Study (FFS) piloting were large diameter drill core and were representative (geographically, of depth, ore type and by lithology). Additionally, 10% of the samples (1 m from every 10 m) was used for variability testing so piloting and variability were related.

Each of the steps in the process are described below:

Beneficiation

The beneficiation process upgrades ROM nickel ore by rejection of free silica to produce a HPAL feed concentrate. There are two trains of beneficiation, each of which includes:

The outcome of the overall beneficiation process is to separate the fine limonite and nickel-bearing clays from the coarser barren silica waste with a grain size greater than 0.15 mm. The coarse silica waste goes to a waste rejects stockpile and the concentrate is fed to the processing plant.

HPAL

The leaching of nickel and cobalt is completed through two HPAL trains, each consisting of a slurry feed tank, medium and high-pressure direct contact heater vessels, autoclave, three stages of flash cooling, associated pumps, piping, reagent and utilities

Slurry neutralization and residue filtration

Similar to HPAL, there are two trains of neutralization and pre-reduction. Each train consists of four neutralization tanks, two pre-reduction tanks, a large leach residue filtration surge tank and associated pumps, piping, reagent dosing and utilities

MSP (Mixed Sulphate Precipitation)

As per the upstream areas, the MSP area is divided into two trains. Each MSP train consists of three agitated reactor vessels, a flash letdown vessel, flash recovery compressor, thickener, filter feed tank, pressure filter, overflow tank, polishing filter, filtrate and backwash tanks, recycles tank, vent gas scrubber, associated pumps, piping and utilities.

The filtered PLS contains soluble nickel and cobalt sulphates plus some other gangue metal cations (zinc, magnesium, manganese, and minor iron, aluminium and calcium, etc.). The solution is pumped to a series of precipitation reactor vessels where nickel and cobalt is precipitated by direct sparging of hydrogen sulphide gas. Direct injection of low-pressure steam is used for heating and recycle surge tank and pumping is included to recover various refinery and scrubber bleed streams to the reactor vessels.

The mixed base metal sulphide (nickel sulphide and cobalt sulphide) exits the pressurised reactor vessels via a flash vessel and is then thickened. Flash vapour is re-compressed and injected back into the reactor vessels to maximise hydrogen sulphide utilization. A large recycle of solids in the thickener underflow is used to act as a seed and promote particle growth in the reactor vessels.

POX (Pressure Oxidation)

Unlike the upstream processes, the POX area consists of a single train that processes all mixed sulphide produced (i.e. from both MSP trains). The mixed nickel-cobalt sulphide filter cake is re-pulped with demineralised water in a re-pulp tank in each train, then pumped to the single MSP surge tank then autoclave feed tank. The mixed sulphide slurry is pumped by piston diaphragm pump to a five-compartment horizontal autoclave

Oxygen is sparged along the length of the vessel to fully oxidise the sulphides to sulphate and solubilise nickel and cobalt. Slurry is withdrawn from compartment one or two and flash cooled to remove heat that is generated from the sulphide oxidation process before being recycled back to the autoclave feed tank

Impurity removal

The purpose of the impurity removal area is to adjust the pH of the PLS from the POX discharge and to precipitate the remaining trace amounts of copper, iron, aluminium and chromium from solution. As per the POX area, the impurity removal circuit consists of a single train. The impurity removal circuit includes six reactor tanks followed by a clarifier, overflow tank, polishing filter and backwash tank and pumps, clarifier underflow recycle and advance pumps, filter feed tank and pressure filter. The impurity removal filter cake is recycled back to HPAL discharge (neutralization area) to leach any co-precipitated nickel and cobalt.

CoSX (Cobalt solvent extraction)

Consistent with POX and impurity removal areas, the CoSX area consists of a single train. The purified PLS from the impurity removal polishing filter is pumped into the CoSX circuit which consists of extraction, scrubbing, sequential cobalt and zinc stripping and nickel pre-loading stages. The circuit uses industry standard Cyanex 272 extractant in a low aromatic content, high flashpoint diluent, to extract the cobalt, leaving the nickel in the raffinate

Nickel and cobalt sulphate crystallization

The cleaned cobalt loaded strip liquor at pH 3 contains 80 g/ℓ cobalt as sulphate, plus only approximately 300 ppm free H2SO4. The liquor is evaporated in a single draft tube baffle crystalliser, operating under vacuum at approximately 50 mBar absolute pressure and less than 40°C. The vacuum is generated by steam-jet thermo vapour re-compression (TVR). A portion of the overhead vapours is re-compressed by the motive steam. This reheats the vapours and allows them to act as heating medium in the crystalliser heat exchanger, thus reducing the net steam demand. The remaining process vapours are re-compressed with a small vacuum booster pump, to raise the pressure and temperature and allow the vapours to be condensed by cooling water in a plate condenser, without needing chilled water.

The crystalliser includes a forced circulation leg, which draws liquor from near the surface of the vapour liquid interface by a low head, high flow axial flow pump. The re-circulating liquor is heated in a shell and tube heat exchanger to just under the boiling temperature, under hydrostatic pressure only. The heated liquor returns to the crystalliser vessel where it flashes. The cobalt sulphate crystallises as the heptahydrate: CoSO4•7H2O, which is the stable phase at the operating temperature and pressure. Settled slurry is pumped to a pusher centrifuge, with a portion of the centrate bled to mixed nickel and cobalt hydroxide precipitation, and the remainder returned to the crystalliser. The cobalt sulphate is centrifuged, and dried, before being packaged in bulk bags for product storage and distribution.

Acid liquor neutralization

The acid liquor neutralization area neutralises plant effluent and recycles it as process water. There are two trains of acid liquor neutralization, consistent with the upstream MSP area. Barren liquor from the MSP area is the main input to the acid liquor neutralization area but minor streams such as zinc strip liquor, POX scrubber bleed and the hydrogen electrolyser scrubber bleed also feed into the acid liquor neutralization area. The area consists of two agitated neutralization tanks, air blower and receiver, thickener, overflow tank, process water pond and associated pumps, piping, reagents and utilities.

Kieserite crystallization

To avoid accumulation of magnesium sulphate in the recycled process water, a portion of the process water is sent to the kieserite crystallization area. Similar to the acid liquor neutralization area, there are two trains of kieserite crystallization. Waste steam from the HPAL area is used in the kieserite crystalliser.

The feed liquor is first concentrated in a falling film pre-concentrator which is operated by means of mechanical vapour re-compression (MVR) units. Pre-concentrator operates close to the solubility limit before feeding to the crystalliser. The crystalliser is a forced circulation type of device, where the solution concentrates at the same time when the crystals are formed. The crystalliser is operated by TVR principle (i.e. vapor is compressed by means of ejector back to heater). Excess amount of vapor is condensed in surface condenser.

Crystal slurry from the crystallization vessel is pumped to the thickener and thickened slurry is led to the centrifuge for solid-liquid separation. The separated crystals are then dried in a fluid bed dryer to final dryness. Drier off-gas is purified by means of cyclones and scrubber. Mother liquor from the thickener and from centrifuge is collected into the mother liquor tank and most of it is recycled back to crystallization.

Dual trains of 1,200 t/d acid plants have been included in the plant design. This is consistent with the dual trains of HPAL and associated processing plant. Outotec sulphur burning, double absorption, acid plants equipped with HEROS™ heat recovery have been selected. The cost compares favourably with that of a water-cooled design, and the additional low-pressure steam and the extra power produced compared to conventional acid plant designs assists with the process plant heat balance and kieserite crystallization area steam requirements.

The PFS base case financial model was developed using a flat nickel price of $16,400/t Ni which is taken from a market consensus price distributed by CIBC. One other case was prepared; the Wood Mackenzie long term incentive forecast of US$19,800/t Ni. This additional price forecasts represent an upside scenario.

The PFS demonstrates robust economics for a 38 year mine, producing in excess of 30,000 tonnes per annum nickel. A discount rate of 8% was used for NPV calculations.

Project economics (post taxation)

| Nickel price basis (US$/t Ni) | |||

| Item | Unit | Consensus (16,800) | Wood Mackenzie (19,800) |

| Net cash flow | US$M | 7,304 | 9,546 |

| NPV8 | US$M | 1,722 | 2,373 |

| IRR | % | 26.3% | 31.5% |

| Breakeven (NPV8) Ni price | US$/t | 7,480 | 7,480 |

| C1 Cost (Brook Hunt) | US$/t | 8,029 | 8,029 |

| Production year payback | years | 4.2 | 3.6 |

| LOM Ni recovered | kt | 924 | 924 |

| LOM Co recovered | kt | 47 | 47 |

| Average Ni production | kt/a | 24 | 24 |

| Peak Ni Production | kt/a | 34 | 34 |

| Total revenue | US$M | 19,034 | 22,175 |

| Total costs | US$M | 11,729 | 12,629 |

| Operating cash flow | US$M | 8,451 | 10,693 |

1 Average over initial 37 years of processing

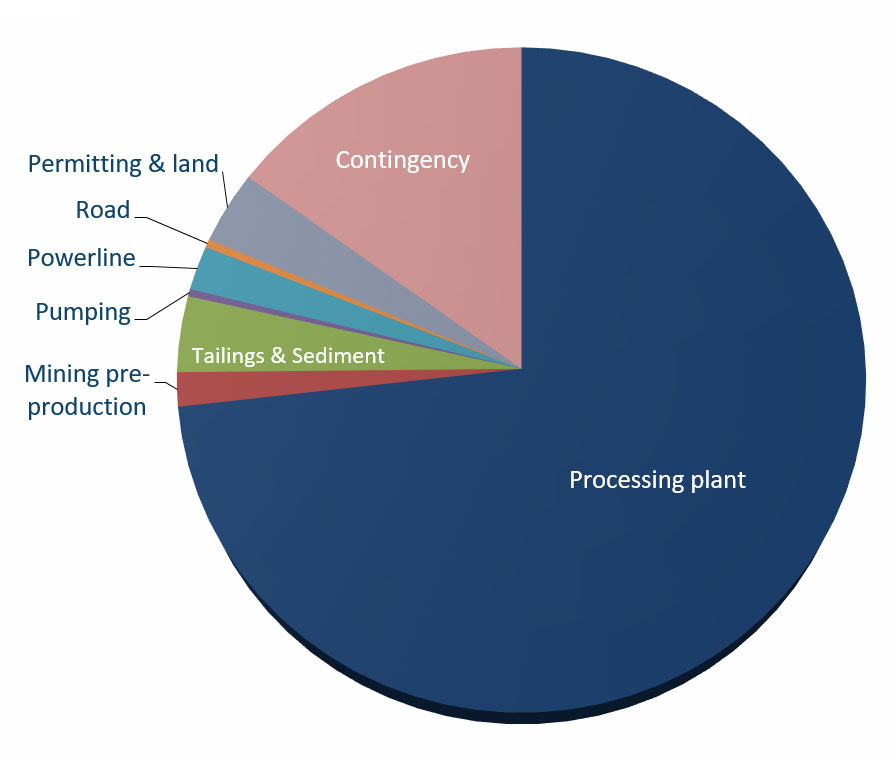

An initial capital cost of US$652 million is estimated for Vermelho

| Area name | Costs (US$‘M) |

| Process Plant | 477.3 |

| Mining pre-production | 10.8 |

| Tailings and sediment | 24.1 |

| Pumping | 2.3 |

| Powerline | 14 |

| Road | 2.6 |

| Permitting & Land Acquisition | 23.2 |

| Contingency | 97.7 |

| Total | 652.2 |

The capital cost estimate was built to an Association for the Advancement of Cost Engineering (AACE class 4) level which delivers an accuracy range between -25% and +20% of the final project cost (excluding contingency) with a base date of June 2019. All amounts expressed are in US dollars.

The initial 38 year mine life of the PFS design generates free cash flows after taxation of US$7.3 billion returning an IRR of over 26% on an initial capital cost of $US652 million (applying consensus nickel price of $16,400/tonne) and C1 cash cost of $8,029/t Ni during life of mine, $7,286 C1 cash cost in years 1-10.

Tier 1 Project: Low Cost & High Grade

Vermelho positioned in the lower quartile for nickel laterite projects on global C1 (Brooke Hunt) Cash Cost, $7,286 C1 cash cost in years 1-10

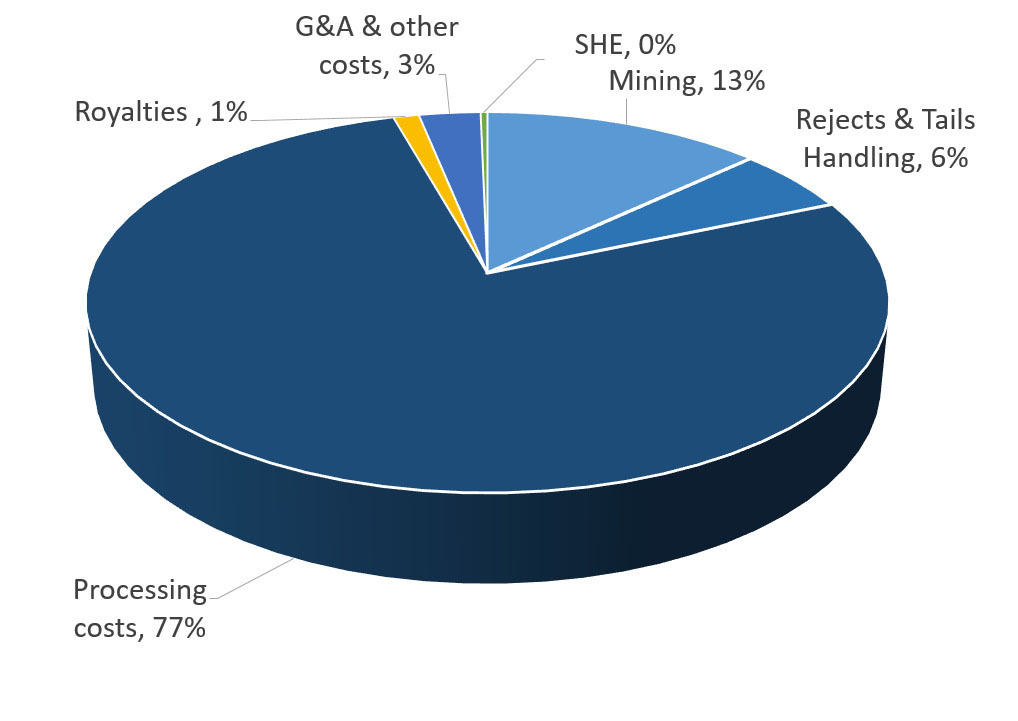

The mining and operating cost estimate (opex) was calculated for an operation producing 14,749t Ni per annum and is set out as an annual total and US$/t Ni in Table below, calculated as an average over the LOM.

| Description | US$/t nickel |

| Mining | 1,062 |

| Rejects & Tails Handling | 448 |

| Processing costs | 6,261 |

| Royalties | 97 |

| G&A & other costs | 233 |

| SHE | 26 |

| Total costs | $8,126 |

The Project is located in the Canaã dos Carajás town, founded in 1994, Pará state, north of Brazil. The Carajás region boasts some of the richest reserves and concentrations of iron ore globally.

Mining and related industries in the Canaã dos Carajás municipality play a vital role in the socio-economic fabric of the region, with the municipality presenting considerable per capita income, the second highest of the Pará state.

The Vermelho project’s pre-feasibility sets out key environmental and social aspects of the project. Important environmental studies for the advancement of project licensing stages were completed by Vale. HZM will utilize the studies and baseline data collected by previous owners to inform and expedite new environmental impact studies.

The following mining and environmental permits were granted to Vale by the end of 2016:

Whilst a new environmental permit pathway is proposed, the previously awarded permits for Vermelho demonstrate very positive signals for HZM. HZM will utilize studies and baseline data collected by previous owners to inform and expedite new environmental impact studies. As HZM will recommence the licensing for Vermelho, the Company will both update studies and undertake new studies to accurately characterize the current physical environment, biological environment and social settings.

The Company anticipates that it will undertake an updated environmental impact study for Vermelho throughout 2020, which is anticipated to lead to the award of a new Preliminary Licence (LP) for the project shortly after.