Pt

Please note that the Company was placed into Administration on 16 May 2024 and Chad Griffin and Geoff Rowley of FRP Advisory were appointed as Joint Administrators.

The Joint Administrators will be winding-down the Company’s operations following which it will cease trading.

Should you have any queries regarding the administration, you can contact the Joint Administrators on hzmplc@frpadvisory.com.

The Joint Administrators act as agents of the Company and without personal liability.

The Company entered Administration on 16 May 2024. The affairs, business and property of the Company are being managed by the appointed Joint Administrators Chad Griffin and Geoffrey Paul Rowley.

Horizonte Minerals Plc, (AIM/TSX: HZM) ('Horizonte' or 'the Company') the nickel development company focused in Brazil, is pleased to announce that it has filed the Feasibility Study (‘FS’ or the ‘Study’) for the Araguaia Ferronickel Project (‘Araguaia’, or ‘the Project’) in Brazil’s Pará State on SEDAR. The Study has been prepared in accordance with the National Instrument 43-101 – standards of Disclosure for Mineral Projects (‘NI 43-101’) and was previously announced on the 29th October 2018.

The Study confirms Araguaia as a Tier 1 project with a large high-grade scalable resource, a long mine life and a low-cost source of ferronickel for the stainless-steel industry. The Stage 1 FS design allows for future construction of a second Rotary Kiln Electric Furnace (‘RKEF’) process line (‘Stage 2 expansion’ or ‘Stage 2’), with potential to double Araguaia’s production capacity from 14,500 tonnes per annum (‘t/a’) nickel up to 29,000 t/a nickel. The results of this Stage 2 expansion study are included as an opportunity in Section 25 of the NI 43-101 Technical Report with the economics highlighted below.

Stage 1 - FS Highlights:

Stage 2 - Second Line Expansion Highlights:

A key part of the FS Stage 1 Project design was that the RKEF plant and associated infrastructure was designed to accommodate the addition of a second RKEF process line (Stage 2 expansion), with potential to double Araguaia’s production capacity from 14,500 t/a nickel up to 29,000 t/a nickel. The Project Mineral Resource inventory has the grade and scale to support the increase in plant throughput from 900 kt/pa (Stage 1) to the Stage 2 rate of 1.8 Mt/a supporting the twin line RKEF flow sheet. The Stage 2 expansion assumes operating at Stage 1 production rate of 900 kt/pa for three years, after which free cash flows would be reinvested to expand the plant to 1.8 Mt/pa by the addition of a second line. All figures below represent this combined production of stage 1 for 3 years followed by the enlarged production for the remainder of the Life of Mine.

Horizonte CEO, Jeremy Martin, commented;

“Following on from the successful completion of the Feasibility Study for the Araguaia ferronickel project, we are very pleased to file the 43-101 Feasibility Technical Report which includes as an opportunity the Stage 2 expansion to add a second RKEF line to the Project. The Stage 2 expansion would potentially increase annual nickel production from 14,500 tonnes per annum to 29,000 tonnes per annum whilst demonstrating economies of scale for both operating and capital costs. For this scenario the upfront pre-production capital cost remains unchanged at US$443 million and the incremental capital expenditure to build the stage 2 expansion, is anticipated to be financed out of operational free cash flow. The FS design of the RKEF plant and all associated infrastructure was configured to allow a second RKEF line to be added at a future time, as such the Stage 2 expansion benefits from the existing utilities and infrastructure expenditure. Significant items such as the powerline, water pipeline, overall process plant site, utilities, and slag storage facility already have sufficient capacity built in during the Stage 1 planning to meet the desired production increase.

The economics of the Stage 2 expansion in year 3 are compelling with the Base Case NPV8 of US$741 million and IRR of 23.8%, increasing to an IRR of 31.8% when applying consensus nickel price assuming no change in the upfront capital investment for the Stage 1 single line RKEF plant as shown in the FS. If we apply a nickel price of US$11,000 per tonne nickel, the enlarged twin line plant generates cash flows after taxation and pay back of capital of US$1.0 billion.

We have always maintained that Araguaia has a high grade scalable mineral resource with only a small part utilised for the single line plant. As demonstrated in the Stage 2 expansion the resource can comfortably support the increased capacity for over 26 years with the first 10 years averaging 1.82% nickel which places Araguaia on the upper range of the global grade curve even with the increased mining rate.

The recent weakness in nickel prices appears to be reflection of macroeconomics and does not appear to have impacted wider consensus of the positive future potential of the nickel market. Demand versus supply deficits remain forecast for the short term. Inventories on the LME continue to fall with significant new supply required for the stainless-steel market which is growing at 5% [6] year on year, with new demand driven from the EV battery sector. Araguaia is anticipated to come online in 2021 and be placed in the lower quartile [7] on the laterite C1 cost curve (year 1 to year 10 of US$3.08 per pound of nickel (US$6,794/t) [8] making it one of the lower cost new nickel projects. Meanwhile the forward C1 cost curve is expected to consistently rise due to the rising costs of inputs as well as the reducing global grade profile across existing mines.

The successful completion of the Feasibility Study and the positive economics from the Stage 2 expansion all confirm that Araguaia is a tier 1 asset demonstrating flexibility and scalability with compelling economics.

The Company is well funded as we work to advance Araguaia to the construction stage and start to advance our second 100% owned Vermelho Nickel Cobalt project as part of the company’s strategy to become a leading nickel development Company. I look forward to updating the market on progress as we move into 2019.”

Stage 2 Second Line Expansion Details:

The FS plant ore feed rate of 900kt/a is based on a single line RKEF plant (Stage 1). This size plant represents the optimal capacity for an achievable capital cost for project financing for a single project junior development company. However, the Stage 1 plant capacity underutilises the significant Mineral Resource that HZM has within the project area (~119Mt Measured and Indicated Mineral Resources at 1.27% Ni). In the FS, the cut-off grade is 1.4% Ni and represents a “high-grade” option. The marginal cut-off grade for the Project is closer to 1.0% Ni. This means that there is a significant quantity of potentially economic material that is not mined or processed in the current Stage 1 FS schedule. Accordingly, the opportunity contemplated here is that the Stage 1 production scenario (the FS Base Case) is built and produces at an initial production level 14,500 t/a of Nickel, and that the Stage 2, expansion in year 3 is implemented as the project starts generating cash flows, thereby increasing total production to 29,000 t/a Nickel.

To explore the potential value of increasing the production rate at Araguaia, a Stage 2 expansion to 1,800kt/a plant feed in Year 3 was contemplated at a scoping level. In this Stage 2 scenario, Snowden completed pit optimisations based on the FS costs and modifying factors. The pit optimisations targeted any material determined to be economic, rather than the elevated Ni cut-off grade applied in the FS. Only Measured and Indicated Mineral Resources were considered in this scenario. Overall, the target was to achieve a similar mine life to the FS schedule (~28 years). This was achieved by selecting a revenue factor pit shell equivalent to a nickel price of US$11,200/t Ni which yields 44.0Mt of ore feed.

The Stage 1 FS plant layout was designed to allow for the future construction of a second RKEF line. A significant portion of the Stage 1 RKEF plant and associated infrastructure has sufficient capacity to support the Stage 2 expansion, resulting in substantially lower capital costs to implement the second RKEF line. The Stage 1 equipment and infrastructure that does not require upgrading for Stage 2 includes;

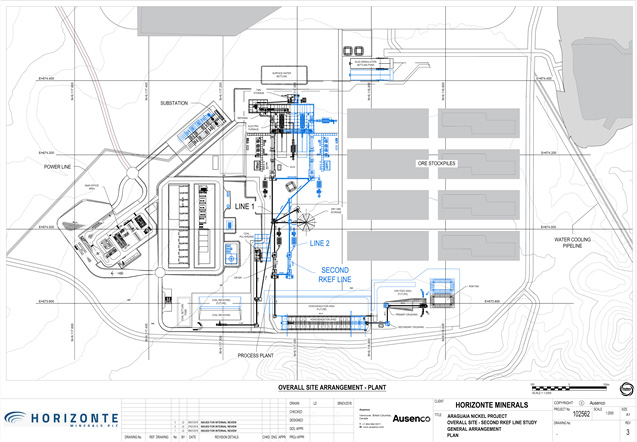

As part of the preparation of the Stage 2 expansion, HZM has completed a scoping level estimate of the costs associated with implementing a second RKEF line after Year 3 of the mine life using the FS capex as a basis and locating the additional equipment in the areas shown in Figure 1 within the existing FS plant layout. A summary of the estimated direct equipment costs along with associated civil works and installation costs for the Stage 2 expansion are shown in Table 1 .

Figure 1 FS Plant layout with Stage 2 - Second line items shown in blue

Table 1 Stage 1 and Stage 2 capex

|

WBS |

Area |

Stage 1 FS Pre- production Capex (US$ million) |

Stage 2 – Second RKEF line Pre- production Capex (US$ million) |

Equipment Additions for Stage 2 |

|

1000 |

Mine |

6.0 |

- |

NA |

|

3000 |

Ore Preparation |

39.0 |

25.2 |

Dryer |

|

4000 |

Pyrometallurgy |

137.5 |

109.2 |

Kiln, Furnace |

|

5000 |

Material Supply |

21.4 |

8.6 |

Coal pulverisation |

|

6000 |

Utilities and Infrastructure |

106.9 |

18.5 |

Substation, water pumping, cooling dam lift, water cooling pipe |

|

7000 |

Buildings |

9.1 |

0.6 |

Admin, change house, canteen |

|

8000 |

Indirect Costs |

82.4 |

22.0 |

EPCM, Owners, Construction Camp, engineering |

|

Contingency |

41.0 |

15.6 |

Contingency |

|

|

Total capex |

443.1 |

199.7 |

The additional costs for the Stage 2 – Second RKEF line shown in Table 1 above, represent sustaining capital expenditure which would be financed once the Stage 1 operation is cash flow positive. Therefore, the pre-production capital costs would remain the same as the FS at US$443.1 million.

Key additional items required within the plant area for Phase 2 are included in Table 1; ore preparation dryer, kiln and furnace. Items outside of the plant area include additional pumping capacity for the water abstraction pipeline, a second plant cooling water pipeline and an increase in the cooling water dam capacity.

The operating costs after the Stage 2 RKEF line becomes fully operational were estimated based on the FS operating cost estimate. A comparison of the physicals and the economics of the FS and the expansion opportunity are shown Table 2 below.

Table 2 Comparison of physicals and financial KPI’s for the FS case and the Stage 2 Expansion [9]

|

Item |

Unit |

FS Stage 1 |

Stage 2 – Second Line RKEF Expansion |

||

|

Base Case (US$14,00/t Ni) |

Consensus case (US$16,800/t Ni) |

Base Case (US$ 14,000/t Ni) |

Consensus case (US$16,800/t Ni) |

||

|

Physicals |

|||||

|

LOM plant feed [10] |

Mt |

27.3 |

27.3 |

44.1 |

44.1 |

|

Process rate |

kt/a |

900 |

900 |

1,800 [11] |

1,800 11 |

|

Year 1- 10 Ni grade |

% |

1.91 |

1.91 |

1.82 |

1.82 |

|

LOM Ni grade |

% |

1.69 |

1.69 |

1.53 |

1.53 |

|

LOM Nickel production |

kt |

426 |

426 |

624 |

624 |

|

Strip ratio |

w:o |

2.1 |

2.1 |

1.9 |

1.9 |

|

Mine life |

years |

28 [12] |

28 12 |

26 [13] |

26 13 |

|

Economics |

|||||

|

Pre-production Capital |

US$ M |

443 |

443 |

443 |

443 |

|

LOM Sustaining Capital cost |

US$ M |

143 |

143 |

396 |

396 |

|

Capital Intensity – Initial capex/t Nickel |

US$/t Ni |

1,041 |

1,041 |

710 |

710 |

|

C1 Cost (Brook Hunt) |

US$/t Ni |

8,193 |

8,193 |

7,737 |

7,737 |

|

C1 Cost (Brook Hunt) Years 1- 10 |

US$/t Ni |

6,794 |

6,794 |

6,613 |

6,613 |

|

Breakeven (NPV8) Ni price |

US$/t |

10,766 |

10,766 |

10,105 |

10,105 |

|

Total Revenue |

US$ M |

5,970 |

7,164 |

8,742 |

10,490 |

|

Total cost |

US$ M |

3,811 |

3,995 |

5,351 |

5,617 |

|

Operating cash flow |

US$ M |

2,159 |

3,169 |

3,391 |

4,876 |

|

Net cash flow |

US$ M |

1,572 |

2,582 |

2,552 |

4,033 |

|

NPV8 |

US$ M |

401 |

740 |

741 |

1,264 |

|

IRR |

% |

20.1 |

28.1 |

23.8 |

31.8 |

Report Filing

A technical report on this FS, prepared in accordance with the NI 43-101 reporting requirements, has been filed on SEDAR at www.sedar.com and at www.horizonteminerals.com

Qualified Persons

Mr Frank Blanchfield, B.Eng, FAusIMM, Principal Consultant, Snowden Mining Industry Consultants Pty Ltd;

Mr Andrew Ross, BSc (Hons), MSc, FAusIMM, Principal Consultant, Snowden Mining Industry Consultants Pty Ltd;

Mr Francis Roger Billington, BSc (Hons), P.Geo. (APGO), Consultant;

Dr Nicholas Barcza, BSc (Eng.), MSc (Eng.), PhD, Pr.Eng. (ECSA), HLFSAIMM, Metallurgical Engineering Consultant;

Mr. David Haughton, B. Sc, MIMM, C Eng, Senior Process Engineer on behalf of Canadian Engineering Associates Ltd; and

Mr Robin Kalanchey, BASc.(Metals and Materials Engineering), P.Eng., Director, Minerals and Metals Western Canada, Ausenco Engineering Canada Inc (Ausenco);

are the Qualified Persons under NI 43-101, and have reviewed, approved and verified the technical content of this press release, related to their area of expertise.

For further information visit www.horizonteminerals.com or contact:

|

Horizonte Minerals plc |

||

|

Jeremy Martin (CEO) |

+44 (0) 203 356 2901 |

|

|

Numis Securities Ltd (NOMAD & Joint Broker) |

||

|

John Prior Paul Gillam |

+44 (0) 207 260 1000 |

|

|

Shard Capital (Joint Broker) |

||

|

Damon Heath Erik Woolgar |

+44 (0) 20 186 9952 |

|

|

Tavistock (Financial PR) |

||

|

Emily Fenton Gareth Tredway |

+44 (0) 207 920 3150 |

|

About Horizonte Minerals:

Horizonte Minerals plc is an AIM and TSX-listed nickel development company focused in Brazil. The Company is developing the Araguaia project, as the next major ferronickel mine in Brazil, and the Vermelho nickel-cobalt project, with the aim of being able to supply nickel and cobalt to the EV battery market. Both projects are 100% owned.

Horizonte shareholders include: Teck Resources Limited, Canaccord Genuity Group, JP Morgan, Lombard Odier Asset Management (Europe) Limited, City Financial, Richard Griffiths and Glencore.

Glossary of technical terms

|

AACE |

Association for the Advancement of Cost Engineering |

|

AACE Class 3 |

+-10% +15% accuracy |

|

Agglomerated |

Made into small lumps |

|

Al2O3 |

Aluminium Oxide |

|

ANN |

Araguaia Nickel North (the Northern deposit) |

|

ANS |

Araguaia Nickel South (the Southern deposits) |

|

C1 |

C1 cash cost as defined by Brook Hunt |

|

Calcine |

Output from the kiln which is ore that is reduced by heating in the presence of oxygen and coal |

|

Capex |

Capital cost |

|

Co |

Cobalt |

|

Cut-off grade |

Lowest grade of mineralisation material considered economic, used in the calculation of ore resources |

|

Cr2O3 |

Chromium Oxide |

|

Dilution |

Waste or low-grade material accidently mined with the ore |

|

EPC |

Engineering Procurement and Construction |

|

EPCM |

Engineering Procurement and Construction Management |

|

EV |

Electric Vehicles |

|

Fe |

Iron |

|

FeNi30 |

Ferronickel with 30% Nickel and 70% Iron |

|

Ferronickel or FeNi |

An alloy that contains approximately 30% nickel and 70% iron and is the produced by the project as an ingot |

|

HZM, Horizonte or the Company |

Horizonte Minerals plc |

|

IFC |

International Finance Corporation |

|

IRR |

Internal Rate of Return |

|

Kt |

Thousand Tonnes (metric) |

|

LME |

London Metal Exchange |

|

LOM |

Life of mine |

|

Loss |

Ore that is unintentionally left behind or mined as waste |

|

MgO |

Magnesium Oxide |

|

MT |

Million Tonnes (metric) |

|

Ni |

Nickel |

|

NPV8 |

Net present value at an 8% discount rate |

|

Opex |

Operating cost |

|

Ore |

A naturally occurring solid material from which a metal or valuable mineral can be extracted profitably |

|

PEA |

Preliminary Economic Assessment |

|

Reverse Circulation Drilling |

A rock drilling system that circulates drill cuttings through the centre of the drill rod so that they can be collected and assayed without contamination |

|

RKEF |

Rotating Kiln Electric Furnace is the process by which nickel laterite ore is reduced and then melted in so that metal is separated from the slag to produce ferronickel |

|

ROM |

Run of mine stockpile |

|

Shotted |

Formation of small pellets from molten material |

|

SiO2 |

Silicon Dioxide |

|

Tpa |

Tonnes (metric) per annum |

|

US$ |

United States Dollar |

|

WM |

Wood Mackenzie |

|

Mineral Reserves |

Mineral Reserves are sub-divided into 2 categories. The highest level of Reserves or the level with the most confidence is the `Proven' category and the lower level of confidence of the Reserves is the `Probable' category. Reserves are distinguished from resources as all of the technical and economic parameters have been applied and the estimated grade and tonnage of the resources should closely approximate the actual results of mining. The guidelines state "Mineral Reserves are inclusive of the diluting material that will be mined in conjunction with the Mineral Reserve and delivered to the treatment plant or equivalent facility." The guidelines also state that, "The term `Mineral Reserve' need not necessarily signify that extraction facilities are in place or operative or that all government approvals have been received. It does signify that there are reasonable expectations of such approvals. |

|

Proven Mineral Reserves |

A `Proven Mineral Reserve' is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

|

Probable Mineral Reserves |

A `Probable Mineral Reserve' is the economically mineable part of an Indicated and in some circumstances a Measured Mineral Resource demonstrated by a least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

|

Minerals Resource |

Mineral Resources are sub-divided into 3 categories depending on the geological confidence. The highest level with the most confidence is the `Measured' category. The next level of confidence is the `Indicated' category and the lowest level, or the resource with the least confidence, is the `Inferred' category. |

|

Indicated Mineral Resource |

An `Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

|

Measured Mineral Resource |

A `Measured Mineral Resource' is that part of a Mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

|

Inferred Mineral Resource |

An `Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling, gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

Except for statements of historical fact relating to the Company, certain information contained in this press release constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, the ability of the Company to complete the Acquisition as described herein, statements with respect to the potential of the Company's current or future property mineral projects; the success of exploration and mining activities; cost and timing of future exploration, production and development; the estimation of mineral resources and reserves and the ability of the Company to achieve its goals in respect of growing its mineral resources; the ability of the Company to complete the Placing as described herein, and the realization of mineral resource and reserve estimates. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, and are inherently subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to risks related to: the inability of the Company to complete the Acquisition as described herein, exploration and mining risks, competition from competitors with greater capital; the Company's lack of experience with respect to development-stage mining operations; fluctuations in metal prices; uninsured risks; environmental and other regulatory requirements; exploration, mining and other licences; the Company's future payment obligations; potential disputes with respect to the Company's title to, and the area of, its mining concessions; the Company's dependence on its ability to obtain sufficient financing in the future; the Company's dependence on its relationships with third parties; the Company's joint ventures; the potential of currency fluctuations and political or economic instability in countries in which the Company operates; currency exchange fluctuations; the Company's ability to manage its growth effectively; the trading market for the ordinary shares of the Company; uncertainty with respect to the Company's plans to continue to develop its operations and new projects; the Company's dependence on key personnel; possible conflicts of interest of directors and officers of the Company, the inability of the Company to complete the Placing on the terms as described herein, and various risks associated with the legal and regulatory framework within which the Company operates. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

[1] NPV calculated using 8% discount rate

[2] USD/BRL 1/3.5 exchange rate applied for life-of-mine

[3] NPV calculated using 8% discount rate

[4] USD/BRL 1/3.5 exchange rate applied for life-of-mine

[5] Wood Mackenzie Short term forecast – see market section of NI 43 -101

[6] Source: Glencore

[7] Data from Wood Mackenzie cost curve

[8] Stage 1 only, C1 cash costs as per FS

[9] The physicals and cashflow assessment presented as Stage 2 in the table are preliminary in nature and are based on a mine schedule and an estimate of the additional plant and equipment needed to achieve the additional capacity. The capital costs for the additional plant and equipment are based on the FS costs, and the cost of installation and civil engineering are factored from the FS costs. Operating costs at the increased capacity are factored based on the FS operating cost estimate.

[10] Includes low grade stockpiles processed at the end of the schedule

[11] Increased process rate commences after year 3

[12] 28 years mining following by 3 years of low grade stockpile processing

[13] 26 years mining followed by 2 years of low grade stockpile processing