Pt

Please note that the Company was placed into Administration on 16 May 2024 and Chad Griffin and Geoff Rowley of FRP Advisory were appointed as Joint Administrators.

The Joint Administrators will be winding-down the Company’s operations following which it will cease trading.

Should you have any queries regarding the administration, you can contact the Joint Administrators on hzmplc@frpadvisory.com.

The Joint Administrators act as agents of the Company and without personal liability.

The Company entered Administration on 16 May 2024. The affairs, business and property of the Company are being managed by the appointed Joint Administrators Chad Griffin and Geoffrey Paul Rowley.

Horizonte Minerals Plc, (AIM/TSX: HZM) ('Horizonte' or 'the Company') the nickel development company focused in Brazil, is pleased to publish the results of the Feasibility Study (‘FS’ or the ‘Study’) for the Araguaia Ferronickel Project (‘Araguaia, or ‘the Project’) in Brazil’s Pará State.

The Study confirms Araguaia as a Tier 1 project with a large high-grade scalable resource and a long mine life, and a low-cost source of ferronickel for the stainless-steel industry.

Araguaia’s FS design allows for future construction of a second Rotary Kiln Electric Furnace (‘RKEF’) process line, with potential to double Araguaia’s production capacity from 14,500 tpa nickel up to 29,000 tpa nickel.

Compelling economic and technical results from the Study expected to support project financing, offtake agreements and future development milestones.

Araguaia’s rapid timeline to production should position it to take advantage of the forecast growth in the nickel market over the short to medium-term.

Highlights:

Horizonte CEO, Jeremy Martin, commented;

“I am delighted to deliver the Feasibility Study for the Araguaia ferronickel project. The Study represents the most significant milestone in the Company’s development to date. From initial discovery by Horizonte combined with the acquisitions from Teck and Glencore, this is the culmination of a long journey and one that not many companies successfully achieve. Horizonte owns one of the largest undeveloped ferro-nickel project’s in the world, in a mining friendly jurisdiction, with good infrastructure and a compelling set of economics as defined in today’s FS.

The FS shows that Araguaia can be a significant low-cost supplier of nickel in the form of high-grade ferronickel to the stainless-steel industry, over the initial 28 year mine life the operation generates cash flows after taxation of US$1.6 billion, delivers an internal rate of return (IRR) of over 20% and sits on the lower half of the global cost curve.

The completion of the FS has taken longer to complete than originally forecast, the schedule change was to ensure that the quality of the engineering and other deliverables are to a high standard, and to include the option within the design to add a second line that would double the capacity to 29,000 tonnes per year of nickel.

With the completion of the FS the priority now becomes to secure project funding and to advance the early works packages. The project is unleveraged and is in a strong position with no agreed offtake, royalty or nickel stream, giving maximum value and flexibility going into the financing process.

The nickel market fundamentals are positive for the short to long term, driven by robust demand from stainless steel growth and strong electric vehicle (EV) penetration rates. Physical LME metal inventories continue to be drawn down to levels not seen in the last 5 years. This combined with a lack of new major projects scheduled to come online in the short term, means that this is an opportune time to develop Araguaia.

“I would like to thank the entire Araguaia feasibility study team, who have worked extremely hard to deliver this high-quality study. Horizonte is entering a new and exciting phase of its journey from explorer to developer, with the potential to create substantial value for all stakeholders as highlighted from the results today. I look forward to providing further updates to the market on progress, at both our flagship Araguaia ferro-nickel project and on the Vermelho nickel -cobalt project.”

3D image of the proposed RKEF plant at the Araguaia Nickel Project

Analyst conference call and presentation

Horizonte will host an analyst conference call and presentation today, [**] October 2018, at [**:**] BST. Participants can access the call by dialling one of the following numbers below approximately 10 minutes prior to the start of the call.

UK Toll-Free Number: 08082370030

UK Toll Number: +44 (0)2031394830

The presentation will be available for download from the Company’s website www.horizonteminerals.com or by clicking on the link below:

http://www.anywhereconference.com/?UserAudioMode=DATA&Name=&Conference=131699934&PIN=75301112

A recording of the conference call will subsequently be available on the Company’s website.

Araguaia Feasibility Study Detailed Information

Section 1 - Project Summary

The wholly owned Araguaia Project is located in the south-east of the Brazilian state of Pará, approximately 760 km south of the state capital Belém.

The Project comprises an open pit nickel laterite mining operation that mines 27.5 million tonnes (‘Mt’) Mineral Reserve of a 119 Mt Mineral Resource to produce 52,000 tonnes of ferronickel (‘FeNi’) (containing 14,500 tonnes of nickel) per year, for the 28 year mine life. The metallurgical process comprises a single line RKEF to extract FeNi from the laterite ore. The RKEF plant and project infrastructure will be constructed over a 31-month period. After an initial ramp-up period, the plant will reach full capacity of approximately 900,000 tonnes of dry ore feed per year. The FeNi product will be transported by road to the port of Vila do Conde for sale to overseas customers.

The process plant, mining, infrastructure and utilities engineering has been developed to support capital and operating cost estimates to the Association for the Advancement of Cost Engineering (‘AACE’) class 3 standard. This means that capital and operating costs estimates have a combined accuracy of - 10%+15%. The capital and operating costs are as of Q3 2018.

The results of the FS demonstrate that Araguaia shows compelling economics as highlighted in Table 1, below.

Table 1 Key Feasibility Study Project Economic Indicators (post taxation)

|

Item |

Unit |

Nickel price basis (US$/t Ni) |

||

|

Base |

CIBC |

Wood Mackenzie (26,450) |

||

|

Net cash flow |

US$M |

1,572 |

2,582 |

6,060 |

|

NPV8 |

US$M |

401 |

740 |

1,906 |

|

IRR |

% |

20.1 |

28.1 |

50.4 |

|

Breakeven (NPV8) Ni price |

US$/t |

10,766 |

10,766 |

10,766 |

|

C1 Cost (Brook Hunt) |

US$/t Ni |

8,193 |

8,193 |

8,193 |

|

Production year payback |

years |

4.2 |

3.3 |

1.8 |

|

LOM Ni recovered |

kt |

426 |

426 |

426 |

|

LOM Fe recovered |

kt |

995 |

995 |

995 |

|

Average Ni production at 0.9 Mt/a ore[3] |

kt/a |

14.5 |

14.5 |

14.5 |

|

Average Fe production at 0.9 Mt/a ore |

kt/a |

32 |

32 |

32 |

|

Total revenue |

US$M |

5,970 |

7,164 |

11,449 |

|

Total costs |

US$M |

3,811 |

3,995 |

4,657 |

|

Operating cash flow |

US$M |

2,159 |

3,169 |

6,792 |

|

Capital intensity – Initial capex/t nickel |

$US/t Ni |

1,041 |

1,041 |

1,041 |

The model assumes 100% equity, providing scope for increased returns with the ability to leverage using commercial or other debt. The base case was developed using a flat nickel price of US$14,000/t Ni in line with Wood Mackenzie’s (‘WM’) short term forecast. Two other cases were prepared; one using a market consensus price of US$16,800/t Ni and the other used WM’s long term forecast of US$26,450/t Ni. These two additional price forecasts represent upside scenarios.

As shown in Table 1 (above), for the base case the project has a 4.2-year payback period with cumulative gross revenues of US$5,970 million. The economic analysis indicates a post-tax NPV of US$401 million and an IRR of 20.1% using the base case forecast of US$14,000/t Ni, this increases to US$1,906 million and 50.4% when using the long-term price forecast by WM of US$26,450/t Ni.

Section 2 – Resources / Reserves and Mining

Snowden Mining Industry Consultants completed the mining engineering along with mining capital and operating cost estimates and resource estimation for the project.

Snowden is a global mining consulting and training business with leading skills and technologies in mining engineering, mine optimisation, and resource estimation.

Mineral Resources

The Project has two principal mining centres; Araguaia Nickel South (‘ANS’) and Araguaia Nickel North (‘ANN’). ANS hosts seven deposits: Pequizeiro, Baiao, Pequizeiro West, Jacutinga, Vila Oito East, Vila Oito West and Vila Oito, while ANN hosts the Vale do Sonhos deposit.

A number of phases of diamond drilling has been completed across the project commencing in 2010. Drilling at ANS has been undertaken by Horizonte and Teck, with drilling at ANN by Xstrata/Glencore. The Company has been active on the ANS project since the initial discovery in 2010, when it successfully completed the acquisition and integration of the Teck and Xstrata project areas, it has been the sole project operator since 2015. A total of 75,250 metres (‘m’) of diamond drilling has been completed across 2,627 holes for the Project.

Mineral Resource estimates for the deposits under consideration for the FS are shown in Table 2. The Measured Mineral Resource is estimated at 18 Mt at a grade of 1.44% Ni using a cut-off grade of 0.90% Ni. The Indicated Mineral Resource is 101 Mt at a grade of 1.25% Ni. This gives a combined Mineral Resource of 119 Mt at a grade of 1.27% Ni for Measured and Indicated Mineral Resources at a cut-off grade of 0.90% Ni (inclusive of Mineral Reserves). A further 13 Mt at a grade of 1.19% Ni (at a cut-off grade of 0.90% Ni) is defined as an Inferred Mineral Resource.

Table 2 Mineral Resources for ANS and ANN as of February 2017 by material type (0.90% Ni cut-off)

|

Araguaia |

Category |

Material type |

Tonnage (kt) |

Bulk density (t/m3) |

Contained Ni metal (kt) |

Ni |

Co |

Fe |

MgO |

SiO2 |

Al2O3 |

Cr2O3 |

|

Subtotal |

Measured |

Limonite |

1,232 |

1.39 |

15 |

1.20 |

0.15 |

37.43 |

2.00 |

17.15 |

11.07 |

2.98 |

|

Transition |

6,645 |

1.26 |

116 |

1.75 |

0.07 |

18.89 |

10.20 |

42.06 |

6.59 |

1.29 |

||

|

Saprolite |

10,291 |

1.40 |

130 |

1.27 |

0.03 |

12.03 |

24.08 |

41.24 |

3.95 |

0.87 |

||

|

Total |

Measured |

All |

18,168 |

1.35 |

261 |

1.44 |

0.05 |

16.26 |

17.51 |

39.91 |

5.40 |

1.17 |

|

Subtotal |

Indicated |

Limonite |

19,244 |

1.39 |

216 |

1.12 |

0.12 |

36.22 |

2.40 |

20.46 |

9.61 |

2.65 |

|

Transition |

30,917 |

1.20 |

439 |

1.42 |

0.07 |

21.38 |

11.26 |

38.95 |

5.37 |

1.51 |

||

|

Saprolite |

51,008 |

1.31 |

610 |

1.18 |

0.03 |

11.83 |

25.79 |

40.59 |

3.16 |

0.85 |

||

|

Total |

Indicated |

All |

101,169 |

1.30 |

1,264 |

1.25 |

0.06 |

19.39 |

16.90 |

36.26 |

5.06 |

1.39 |

|

Total |

Measured + Indicated |

All |

119,337 |

1.30 |

1,525 |

1.27 |

0.06 |

18.91 |

16.99 |

36.81 |

5.11 |

1.36 |

|

Subtotal |

Inferred |

Limonite |

2,751 |

1.37 |

30 |

1.08 |

0.10 |

34.92 |

3.04 |

22.84 |

9.23 |

2.50 |

|

Transition |

4,771 |

1.20 |

62 |

1.30 |

0.07 |

21.23 |

11.04 |

39.09 |

5.62 |

1.40 |

||

|

Saprolite |

5,398 |

1.35 |

62 |

1.15 |

0.03 |

11.80 |

24.36 |

41.81 |

3.69 |

0.82 |

||

|

Total |

Inferred |

All |

12,920 |

1.30 |

154 |

1.19 |

0.06 |

20.21 |

14.90 |

36.77 |

5.58 |

1.39 |

Notes:

Mineral Reserves

The Mineral Reserve was estimated by Snowden in accordance with the CIM (2010) and JORC (2012) guidelines.

All economic Indicated Mineral Resources within the pit designs were classified as Probable Mineral Reserves and all Measured Mineral Resources at Pequizeiro (ANS) were classified as Proven Mineral Reserves (this classification was tested and supported by the trial mining program completed in this pit in 2017). Measured Mineral Resources at Vale dos Sonhos (ANN) were classified as Probable Mineral Reserves. A summary is provided in Table 3. The Mineral Reserve of 27.2 Mt gives mine life of 28 years based on the annual ore throughput to the RKEF plant of 900,000 t/a.

Table 3 Open Pit Mineral Reserves reported at October 2018

|

Category |

Ore (Mt) |

Ni (%) |

Fe (%) |

SiO2:MgO |

Al2O3 (%) |

|

Proven |

7.33 |

1.72 |

16.01 |

3.01 |

6.00 |

|

Probable |

19.96 |

1.68 |

17.57 |

2.36 |

4.56 |

|

Total |

27.29 |

1.69 |

17.15 |

2.52 |

4.94 |

Notes

Mining

The deposits will be mined via conventional open pit truck and shovel techniques using contractors. No blasting will be necessary. Reverse circulation (‘RC’) grade control drilling will be completed at a 10 m x 10 m spacing well ahead of mining. This combined with the use of visual control of the limonite and transition boundary, face sampling, stockpile sampling and ore feed sampling, supports a comprehensive mine-to-mill strategy that is designed to maintain consistent feed to the process plant.

Waste will be stored in external dumps near the pits. Ore will be transported to stockpile hubs near each deposit. Sheeting (using ferricrete won from the overburden) will be required to support trafficability in and around the mine during the wet season. Depending on plant demand, ore will be hauled from hub stockpiles or directly from the pits to the run of mine (‘ROM’) at the RKEF process facility. Stockpiles on the ROM will be sheeted and classified according to ore type and chemistry for blending.

The resource model was converted to a mining model to reflect the mining method and incorporated anticipated mining dilution and loss. The model was re-blocked to 6.25 m x 6.25 m x 2 m, with a 300 mm “skin” of transition (directly beneath the limonite boundary) treated as loss.

The pits were optimised to target the highest-grade material giving a mine life of approximately 28 years. This resulted in a cut-off grade of 1.4% Ni being applied. The pits were then optimised using Whittle 4X to determine a shell to use for design.

The annual mining rate peaks at 3.5 Mt/annum between production years two and seven before dropping down to 3.0 Mt/annum for the remainder of the Project.

The mine supplies high nickel grades in the early mine life, reaching 2% in production year 2. The Ni grade is above 1.8% for the majority of the first 10 years of production and reduces to average approximately 1.6% Ni for the remaining mine life.

Section 3 – Processing

The process plant design, along with capital and operating cost estimates were completed by Ausenco Engineering Canada Inc (Ausenco). Ausenco is a global diversified engineering, construction and project management company providing consulting, project delivery and asset management solutions to the resources, energy and infrastructure sectors.

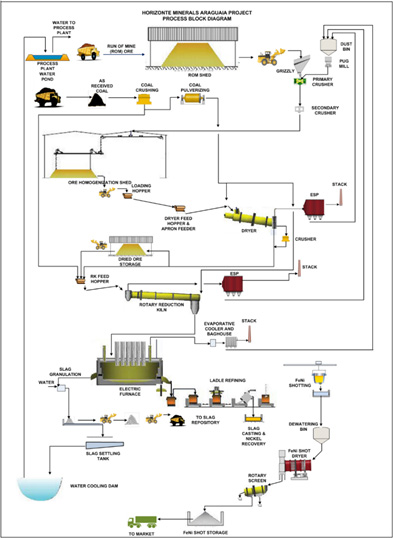

The Project will utilise a single RKEF processing line from ore receipts through to shotting of the FeNi product, Figure 1.

The RKEF process is proven and used successfully in over 40 nickel laterite plants around the world and was deemed appropriate for the Project based on the extensive metallurgical testwork and the pilot plant campaigns completed on the ore.

The key steps in the RKEF flowsheet are (Figure 1);

Figure 1 ANP process flow diagram showing the RKEF steps

Section 4 – Financial Evaluation

Capital Cost

The estimate is based on the AACE class 3 with an accuracy range between -10% and +15% of the final project cost (excluding contingency) with a base date of October 2018. All amounts expressed are in US dollars unless otherwise stated.

The capital costs estimate (‘capex’) includes all the direct and indirect costs, local taxes and duties and appropriate contingencies for the facilities required to bring the Project into production, including the process plant, power line, water pipelines and associated infrastructure as defined by the FS. The estimate is based on an Engineering Procurement and Construction Management (‘EPCM’) implementation approach and the Project contracting strategy.

The total estimated initial (pre-production) capital cost for the project is US$443.1 million (after tax, including growth and contingency, excluding escalation). A summary of the capex is shown in Table 4.

Table 4 Summary of capex

|

WBS # |

Area |

US$’000 |

|

1000 |

Mine |

6,003 |

|

3000 |

Ore Preparation |

38,731 |

|

4000 |

Pyrometallurgy |

137,518 |

|

5000 |

Material Supply |

21,413 |

|

6000 |

Utilities and Infrastructure |

106,918 |

|

7000 |

Buildings |

9,095 |

|

8000 |

Indirect Costs |

82,409 |

|

Contingency |

40,989 |

|

|

Total Costs |

443,076 |

The direct costs in Table 4 include supply, shipping and site installation. The total contingency carried in the capex is US$41.0 million, which combined with the US$24.3 million growth allowance provides a total provision of US$65.3 million. This combined sum represents 17.2% of the total capex (excluding growth and contingency).

Operational costs

The mining and operating cost estimate (‘opex’) was calculated for an operation producing 14,500 t Ni per annum and is set out as an annual total and US$/t Ni in Table 5 (below), calculated as an average over the Life of Mine (‘LOM’). The operating costs cover the mine, process plant, ore preparation, social and environmental, royalties and general and administrative overheads. The main contributors of the overall operating costs are power, coal, labour and mining costs, with additional consumables and other indirect costs, including G&A.

Table 5 Summary of opex

|

Description |

Cost/annum (US$) |

US$/t nickel |

|

Process Plant |

||

|

Directs |

||

|

Power |

$32,114,355 |

$2,410 |

|

Coal |

$21,591,099 |

$1,620 |

|

Other directs |

$17,965,039 |

$1,348 |

|

Labour |

$7,831,286 |

$588 |

|

Subtotal – Direct costs |

$79,501,779 |

$5,966 |

|

Indirects |

$10,285,640 |

$772 |

|

Mining costs |

$21,112,173 |

$1,584 |

|

Total costs |

$110,889,592 |

$8,322 |

Summary Economics

The model assumes 100% equity. The base case was developed using a flat nickel price of US$14,000/t Ni. Two other cases were prepared; one using a market consensus price of US$16,800/t Ni and the other used the WM long term forecast of US$26,450/t Ni. These two additional price forecasts represent upside scenarios.

As shown in Table 1, the post taxation model for the base case at the ANP has a 4.2-year payback period with cumulative gross revenues of US$5,970 million. The economic analysis indicates a post-tax NPV of US$401million and an IRR of 20.1% using the base case forecast of US$14,000/t Ni which increases to US$1,906 million and 50.4% when using the long-term price forecast by WM of US$26,450/t Ni. Table 6 shows the pre-taxation results.

Table 6 Project economic performance (pre-taxation)

|

Item |

Unit |

Nickel price basis (US$/t Ni) |

||

|

Base |

CIBC |

Wood Mackenzie (26,450) |

||

|

Net cash flow |

US$M |

1,834 |

3,208 |

7,313 |

|

NPV8 |

US$M |

456 |

840 |

2,219 |

|

IRR |

% |

21.2 |

29.9 |

55.3 |

|

Breakeven (NPV8) Ni price |

US$/t |

10,672 |

10,672 |

10,672 |

|

C1 Cost (Brook Hunt) |

US$/t Ni |

8,193 |

8,193 |

8,193 |

|

Production year payback |

years |

4.0 |

3.0 |

0.75 |

|

Total costs |

US$M |

4,137 |

4,137 |

4,137 |

|

Operating cash flow |

US$M |

2,421 |

3,616 |

7,901 |

Sensitivity Analysis

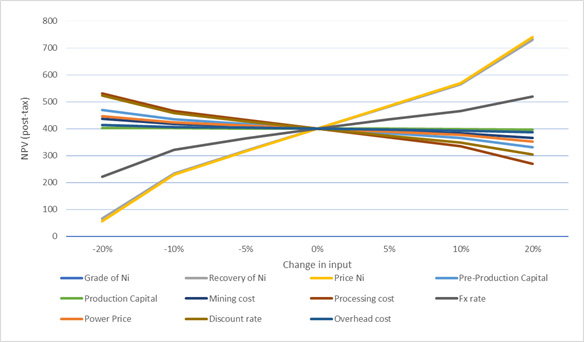

The sensitivity analysis demonstrates how the NPV8 is affected by changes to one variable while holding the other variables constant. The results of the sensitivity analysis are presented in Table 7 and Figure 2. The breakeven (B/E) indicates the change in the variable that will bring the project NPV8 to US$0.000 if all other variables remain unchanged. For example, if the grade of Ni reduces by 23.7% the Project will break even on NPV8.

Table 7 Sensitivity table for the Base Case (US$14,000/t) NPV8, after taxation

|

-20% |

-10% |

-5% |

0% |

5% |

10% |

20% |

B/E[4] |

|

|

Grade Ni |

65 |

234 |

317 |

401 |

483 |

566 |

731 |

-23.7% |

|

Recovery Ni |

65 |

234 |

317 |

401 |

483 |

566 |

731 |

-23.7% |

|

Price Ni |

56 |

230 |

315 |

401 |

485 |

570 |

740 |

-23.1% |

|

Pre-production capital |

469 |

435 |

418 |

401 |

383 |

366 |

331 |

110.2% |

|

Production capital |

403 |

402 |

401 |

401 |

400 |

399 |

397 |

- |

|

Mining cost |

436 |

418 |

409 |

401 |

391 |

383 |

365 |

222.6% |

|

Processing cost |

531 |

466 |

433 |

401 |

367 |

335 |

269 |

59.8% |

|

US$/BRL FX rate |

222 |

321 |

363 |

401 |

434 |

465 |

519 |

-35.4% |

|

Electricity price |

447 |

424 |

412 |

401 |

389 |

377 |

353 |

167.2% |

|

Discount factor |

524 |

458 |

428 |

401 |

374 |

349 |

304 |

151.3% |

|

Overhead cost |

414 |

407 |

404 |

401[P2] |

397 |

393 |

386 |

- |

Figure 2 Sensitivity to NPV8 for changes in various key inputs

The sensitivity analysis shows that the project is more sensitive to nickel price, nickel recovery and grade than it is to either opex or capex.

Section 5 – Market Review and Nickel Pricing

A market study was provided by WM, a global natural resource research and consulting company, with speciality in the nickel industry. WM’s findings are summarised below.

World nickel demand is forecast to increase by 3.6% in 2018, to 2.26 Mt before slowing to a compound annual growth rate of 2.1% a year, reaching 2.61 Mt in 2025. Growth over the long term is slightly stronger, at 2.5% a year, to 3.35 Mt in 2035, due to increasing uptake by the battery segment (for electric vehicles). Over this period, primary nickel uptake in stainless will account for 50–70% of total demand, rising from 1.54 Mt in 2018 to 1.66 Mt in 2025, and 1.77 Mt in 2035.

Thus, with an outlook for nickel of structural shortage, deepening deficits and falling stocks, nickel prices are expected to continue to increase above their recently established range of US$12,500/t to US$15,000/t (US$5.90 to US$6.80/lb). A near term forecast for the purposes of the FS is therefore, US$14,000/t (US$6.35/lb). For comparison, WM’s long-term incentive price currently stands at about US$26,450/t (US$12.00/lb).

The composition of ANP FeNi30 is comparable to existing FeNi30 being produced. Consequently there is no impediment (based on the elemental breakdown provided) to the proposed FeNi30 product being acceptable to the stainless steel market.

World stainless steel production increased by 12 Mt between 2012 and 2017, mostly in China and to a lesser extent across the rest of Asia. Forecast production in 2018 is 50.8 Mt, up 4.5% on 2017. This upward trend is likely to continue over the mid-term, before slowing after 2025. As future growth in stainless production is expected to continue, the demand for FeNi (including FeNi30) should also increase. Consequently, WM forecasts long term FeNi production to be 450,000–460,000 a year, compared with 433,000 in 2018. This suggests there could be a need for the development of new FeNi projects in the future.

Section 6 – Community and Environment

The FS sets out key environmental and social risks and impacts and how the Company plans to minimise, manage and mitigate them and then monitor performance. This will be primarily achieved through a system of Environmental Control Plans, to be implemented before, during and after construction to meet Brazilian and international standards.

The Company is working with Environmental Resource Management (‘ERM’), a global leader in this field, together with local Brazilian groups: Integratio Mediação Social e Sustentabilidade (social and land) and DBO Environmental Engineering (fauna) for the FS environmental and social work streams and the project permitting work for the Construction Licence (Licença de Instalação (‘LI’). All work has been undertaken to IFC Performance Standards, 1, 2 and 5 and Brazilian CONAMA (environmental) legislation.

The groups have conducted a number of new studies in 2017 and 2018 together with ongoing programs, these included:

ANP will generate approximately 500 direct and indirect jobs in the south-eastern rural area of Pará State, over the 28 years of operations. The majority of these workers during the operational phase will reside locally. The peak construction workforce is expected to reach over 1,000.

Community contributions are expected to total over US$700 million during the LOM, including:

Section 7 – Next Steps

Subject to Horizonte’s Board of Directors’ approvals, completion of project financing, approval of the Construction Licence (‘LI’) and overall nickel market conditions, the Company will continue to advance the Project towards construction, the key development milestones will be spilt into two phases, with the next six to eight months focussed on Phase 1.

Phase 1

Phase 2

Report Filing

A technical report on this Feasibility Study, prepared in accordance with the NI 43-101, will be filed on SEDAR at www.sedar.com and at www.horizonteminerals.com within forty-five (45) days of the date of this news release.

Qualified Persons

Mr Frank Blanchfield, B.Eng, FAusIMM,

Mr Andrew Ross, BSc (Hons), MSc, FAusIMM,

Mr Francis Roger Billington, BSc (Hons), P.Geo. (APGO),

Dr Nicholas Barcza, BSc (Eng.), MSc (Eng.), PhD, Pr.Eng. (ECSA), HLFSAIMM, and

Mr. David Haughton, B. Sc, MIMM, C Eng,

are the Qualified Persons under NI 43-101, and have reviewed, approved and verified the technical content of this press release.

For further information visit www.horizonteminerals.com or contact:

|

Horizonte Minerals plc |

||

|

Jeremy Martin (CEO) |

+44 (0) 207 763 7157 |

|

|

Numis Securities Ltd (NOMAD & Joint Broker) |

||

|

John Prior Paul Gillam |

+44 (0) 207 260 1000 |

|

|

Shard Capital (Joint Broker) |

||

|

Damon Heath Erik Woolgar |

+44 (0) 20 186 9952 |

|

|

Tavistock (Financial PR) |

||

|

Emily Fenton Gareth Tredway |

+44 (0) 207 920 3150 |

|

About Horizonte Minerals:

Horizonte Minerals plc is an AIM and TSX-listed nickel development company focused in Brazil. The Company is developing the Araguaia project, as the next major ferro-nickel mine in Brazil, and the Vermelho nickel-cobalt project, with the aim of being able to supply nickel and cobalt to the EV battery market. Both projects are 100% owned.

Horizonte shareholders include: Teck Resources Limited, Canaccord Genuity Group, JP Morgan, Lombard Odier Asset Management (Europe) Limited, City Financial, Richard Griffiths and Glencore.

Glossary of technical terms

|

AACE |

Association for the Advancement of Cost Engineering |

|

AACE Class 3 |

+-10% +15% accuracy |

|

Agglomerated |

Made into small lumps |

|

Al2O3 |

Aluminium Oxide |

|

ANN |

Araguaia Nickel North (the Northern deposit) |

|

ANS |

Araguaia Nickel South (the Southern deposits) |

|

C1 |

C1 cash cost as defined by Brook Hunt |

|

Calcine |

Output from the kiln which is ore that is reduced by heating in the presence of oxygen and coal |

|

Capex |

Capital cost |

|

Co |

Cobalt |

|

Cr2O3 |

Chromium Oxide |

|

Dilution |

Waste or low-grade material accidently mined with the ore |

|

EPC |

Engineering Procurement and Construction |

|

EPCM |

Engineering Procurement and Construction Management |

|

EV |

Electric Vehicles |

|

Fe |

Iron |

|

FeNi30 |

Ferronickel with 30% Nickel and 70% Iron |

|

Ferronickel or FeNi |

An alloy that contains approximately 30% nickel and 70% iron and is the produced by the project as an ingot |

|

HZM, Horizonte or the Company |

Horizonte Minerals plc |

|

IFC |

International Finance Corporation |

|

IRR |

Internal Rate of Return |

|

Kt |

Thousand Tonnes (metric) |

|

LME |

London Metal Exchange |

|

LOM |

Life of mine |

|

Loss |

Ore that is unintentionally left behind or mined as waste |

|

MgO |

Magnesium Oxide |

|

MT |

Million Tonnes (metric) |

|

Ni |

Nickel |

|

NPV8 |

Net present value at an 8% discount rate |

|

Opex |

Operating cost |

|

PEA |

Preliminary Economic Assessment |

|

Reverse Circulation Drilling |

A rock drilling system that circulates drill cuttings through the centre of the drill rod so that they can be collected and assayed without contamination |

|

RKEF |

Rotating Kiln Electric Furnace is the process by which nickel laterite ore is reduced and then melted in so that metal is separated from the slag to produce ferronickel |

|

ROM |

Run of mine stockpile |

|

Shotted |

Formation of small pellets from molten material |

|

SiO2 |

Silicon Dioxide |

|

tpa |

Tonnes (metric) per annum |

|

US$ |

United States Dollar |

|

WM |

Wood Mackenzie |

[1] NPV calculated using 8% discount rate

[2] USD/BRL 1/3.5 exchange rate applied for life-of-mine

[3] Average over initial 28 years of processing

[4] The breakeven change for the variable if all other variables remain unchanged. For example, if the grade of Ni reduces by 23.7% the Project will break even on NPV8.

[P1]Can we add a footnote along the following lines to make clear the Standard that the Reserves are being declared under.

[P2]Why is the base case US$400m? This does not appear in the previous table. Can we add a post-tax NPV8 to the previous table?