Pt

Please note that the Company was placed into Administration on 16 May 2024 and Chad Griffin and Geoff Rowley of FRP Advisory were appointed as Joint Administrators.

The Joint Administrators will be winding-down the Company’s operations following which it will cease trading.

Should you have any queries regarding the administration, you can contact the Joint Administrators on hzmplc@frpadvisory.com.

The Joint Administrators act as agents of the Company and without personal liability.

The Company entered Administration on 16 May 2024. The affairs, business and property of the Company are being managed by the appointed Joint Administrators Chad Griffin and Geoffrey Paul Rowley.

Nickel is the best-performing base metal this year amid falling stockpiles and the looming Indonesian supply embargo.

The nickel market heated up last month and it outperformed the better-known metal, gold. In the early days of September, it appears that Nickel is getting even hotter.

Gold is an easy metal to understand and is frequently in the news. The metal grabbed headlines with its 15.5% rise over the past 3 months (Forbes). In direct comparison to this is nickel, which saw the price on the London Metal Exchange (LME) rise of around 50% in the same 3-month period.

|

|

Gold |

Nickel |

|

|

|

|

|

Symbol |

Au |

Ni |

|

Bid today |

$1,543.70/ounce |

$18,000/tonne |

|

3 month % change |

+15.5% |

+50% |

|

Pureplay AIM listed companies focused on the metal |

Too many to count |

2 |

Orders for LME nickel jumped to their highest levels since March 2018, driven by rising orders across warehouses in Malaysia and Singapore (Numis).

Nickel has continued to take the market by storm after Indonesia said it would halt exports in January 2020. Director general for mining and coal at the Energy and Mineral Resources Ministry said to reporters in Jakarta on Monday that Indonesia had weighed all the pros and cons. “So we took the initiative to stop experts of nickel ores of all quality” he explained (Financial Times).

Indonesia is the world’s second-largest exporter of nickel ore after the Philippines. The objective behind the ban of nickel ore exports is to support the national plan to establish more smelters in country so that Indonesia can sell higher value-added nickel products rather than export ore to offshore smelters (Jakarta Post).

Analysts are predicting that this cut-off or nickel supply could poke a significant hole in the nickel supply chain, a hole the size or around 100,000 tonnes per annum in the nickel market over a number of years. In short, this full ban has come as quite a shock to the industry and the nickel price has reacted accordingly, shooting up to and even going beyond US$18,000/tonne this week.

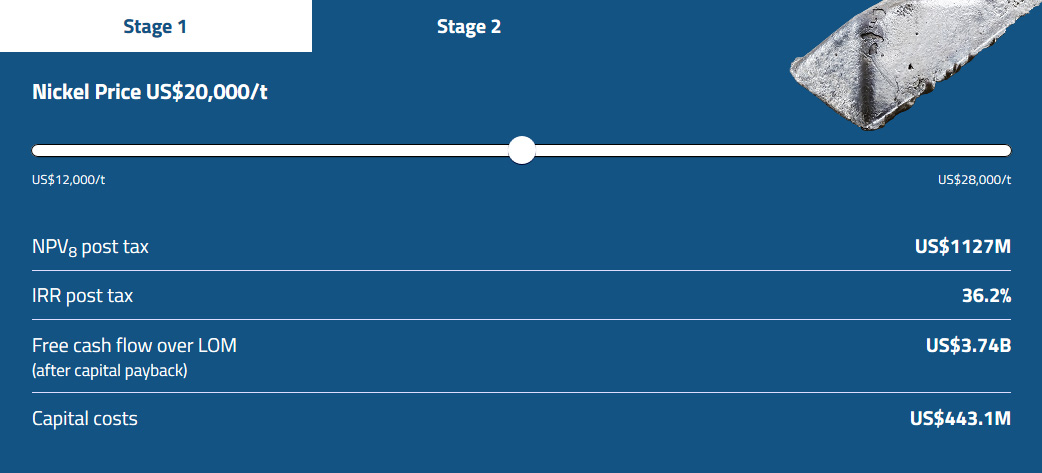

Analysts at Goldman Sachs even predict the nickel price could rise to as much as $20,000/tonne within the next three months (Financial Times). If you were to plug US$20,000/tonne into our interactive Net Present Value (NPV) calculator on Horizonte’s Araguaia ferronickel page https://horizonteminerals.com/uk/en/araguaia_project/, you would see that the project’s anticipated returns are US$1.1B NPV, 36% IRR and makes over US$3.6B free cash-flow over the life of mine.

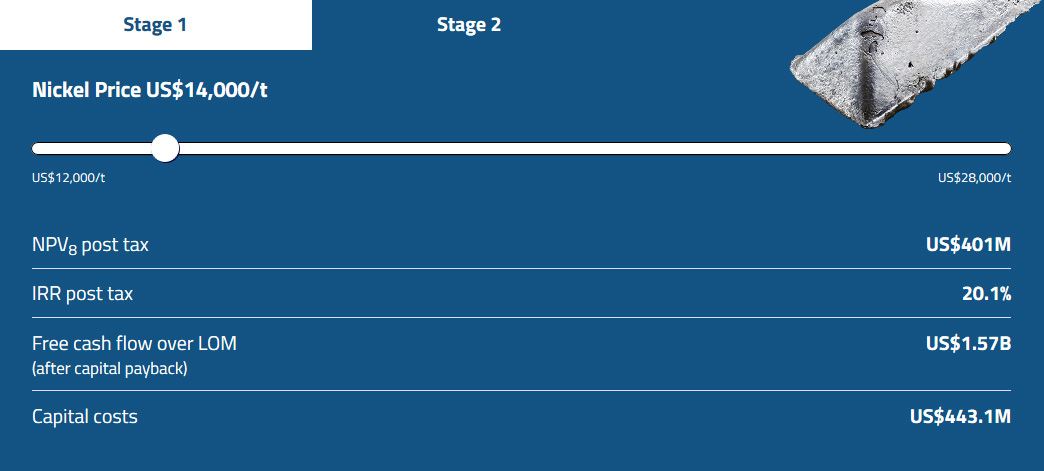

Base Case Economics, Stage 1 production of 14,500 tonnes of nickel per annum:

Economics at US$20,000/tonne, Stage 1 production of 14,500 tonnes of nickel per annum:

“We expect the impact of the Indonesian development to be positive for Horizonte Minerals’ (HZM) Araguaia ferronickel project in Brazil, whose output is targeted at stainless steel” Yuen Low of Shore Cap wrote in his morning notes on 3rd September 2019 (Shore Cap).

In addition to Indonesia’s ban being brought forward from the planned 2022 to January 2020, other supply disruptions are being felt in the nickel market. Metallurgical Corp of China’s Ramu HPAL operation in Papua New Guinea has been threatened with closure following a waste spillage and Vale’s Onca Puma mine in Brazil has recently shut operations. In total we estimate that this is removing approximately 50,000 tonnes of nickel from the global market, affecting both Class 1 and Class 2 nickel supplies.

This is an incredibly exciting time for the nickel market and we invite you to read our Investor Presentation for more details on how to gain exposure to the nickel market through direct investment in Horizonte Minerals on the AIM and TSX markets (AIM: HZM, TSX: HZM).

Sources:

Numis Securities

Forbes

Jakarta Post

Financial Times

Horizonte Minerals Araguaia Project

Shore Cap

Horizonte Minerals Investor Presentation