Pt

The Nickel Price hit over a 10-month high this week. Horizonte Minerals takes a look into contributing factors behind the price hike and future considerations for the commodity.

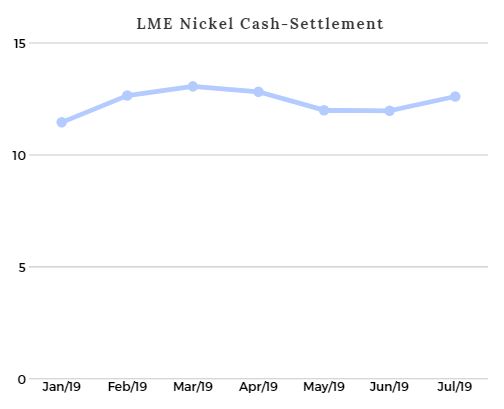

Nickel Price

Both Shanghai and London Metals Exchange nickel prices surged, with the LME closing at $13,350 yesterday on 15th July 2019.

Indonesia Supply Concerns

Yesterday Shanghai nickel prices surged to their highest in over 10 months off concerns that Indonesia would resume an export ban on ore in 2022 (Reuters Singapore).

Abans July 2019 report noted that nickel prices rallied to a multi-month high on the export ban speculation in Indonesia, stating “Indonesia relaxed a ban to export nickel ore in 2017 but said that exports will be restricted again in 2022… Indonesia has been responsible for nearly 100% of the growth in exports since 2015 and has become the single largest exporter of charge nickel” (www.abans.co.in).

Indonesia is the world’s number one supplier of nickel. If Indonesian ore bans are reinforced in 2022, this could significantly disrupt the nickel market.

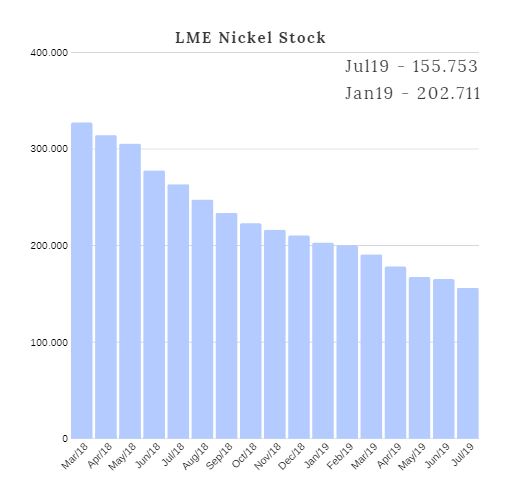

Supply

The nickel market fundamentals continue to move in the right direction for nickel investors, with nickel inventories on the London Metal Exchange down to around 150,000 tonnes today.

At the International Nickel Conference held by FastMarkets in Amsterdam in June 2019, concerns were raised about sufficient supply coming online to meet demand and the long lead time to bring Greenfield projects online, which typically range from 8-10 years for nickel mines.

Leader of the McKinsey EV battery materials research group, Ken Hoffman, told the Fastmarkets Battery Materials conference in Shanghai of April that battery companies and automakers were “petrified about supply” (Reuters Beijing). Mr Hoffman similarly stated at the Fastmarkets Nickel Conference that miners needed to “wake up” and produce more nickel.

Demand

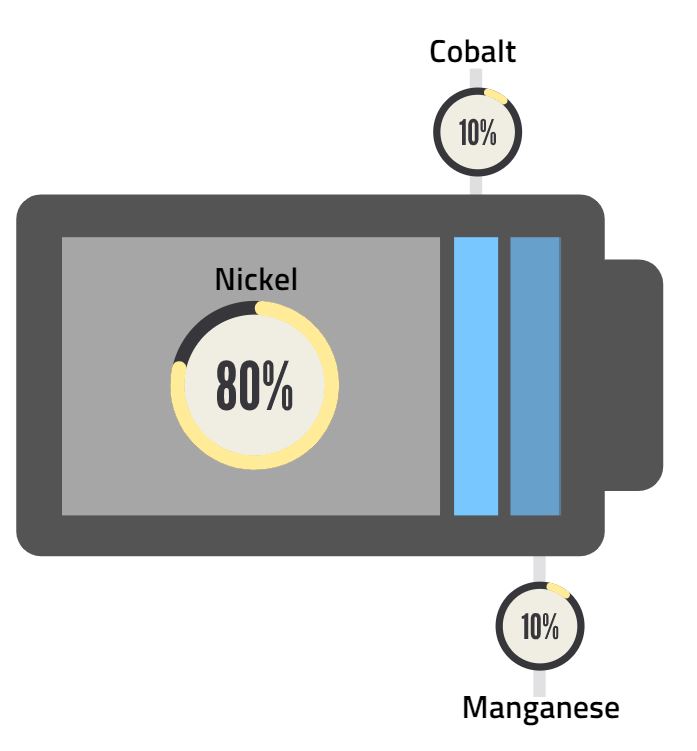

Stainless steel remains the dominant player of the nickel market; however, disrupting forces are imminent for the nickel market with lithium-ion batteries production increasing and producers turning to the NCM 811 battery, which contains 80% nickel, 10% cobalt and 10% manganese.

Reuters Beijing reported late April 2019 that China’s CATL had started mass production of high-nickel batteries (80% nickel). (Reuters Beijing)

In their Nickel Sulphate Market Outlook to 2028 report, Roskill tipped Nickel Sulphate demand would jump more than fourfold in the next decade (MiningNews.net)

Tesla’s CEO Elon Musk in a throw-away comment reported by techcrunch.com indicated that demand was so high and supply so limited for nickel, that Tesla might get into the business of mining raw materials used in electric vehicles. “There’s not much point in adding product complexity if we don’t have enough batteries,” Elon Musk said. “That is complexity, but without gain.”

Macro Economics

US-China trade tensions have seen China’s economy struggle to gain momentum over the past year with a flow-on affect to base metals prices. However, a widely expected interest rate cut by the U.S. Federal Reserve later this month is tipped by analysts to give China’s economy a boost (CNBC).

Asian shares advanced yesterday and data coming out of China suggested that the economy may be starting to show green shoots (uk.investing.com), due to reduction in trade tensions combined with stimulus policies from Beijing.

Horizonte’s View

Having fallen from 470,000 tonnes to approximately 150,000 tonnes at present, nickel inventories on the LME have continued to drop and are now at their lowest levels in over five years. Significant new supply is required for the stainless-steel market which is growing at around 5% year on year, with further additional new demand driven from the Electric Vehicle (EV) market the world remains relatively low at 3 million cars today, forecasts for the acceleration of adoptions of EV’s vary from 20 to 40 million cars on the roads by 2030, representing an estimated approximate 10-fold increase. At present it is difficult to see where significant new supply to meet this demand is going to materialize from.

Nickel reached an all-time high of $54,050/tonne in May of 2007.

Horizonte Minerals management team subscribes to the Wood Mackenzie nickel price forecasts, with a current long-term incentive price of around $19,850/tonne.

Our construction-ready Araguaia Feasibility Study economics demonstrate robust results at $14,000/tonne nickel and is a rare Greenfield nickel project that is profitable in today’s nickel price environment. In addition, we are developing the Vermelho nickel cobalt project, with the aim of being able to supply nickel and cobalt to the EV battery market. Both projects are 100% owned.

Horizonte’s view is that now is the right time to develop nickel projects that are profitable in today’s price environment and have advanced along the permitting pathway.

Sources: