Pt

Electric vehicles (EVs) are not only rapidly becoming an important part of the automotive landscape, they’re contributing to the creation of a new, and growing, demand source for a variety of raw materials, the mix of which depends on advances in battery chemistry technologies.

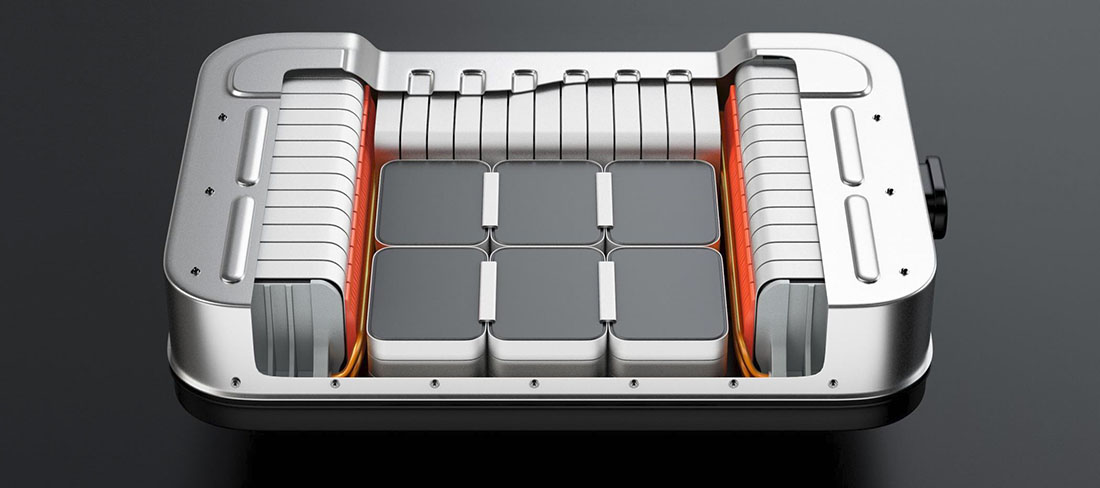

Types of batteries can be regarded as a key differentiator between the various EV manufacturers. The amount of energy stored in a battery determines the range of the vehicle and is considered to be a major influencing factor on a consumer’s decision on which EV model to buy.

Major research and development programmes are underway to find the perfect composition of these batteries, but with OEM manufacturing programmes fixed for several years, changing over to a new type does not happen overnight.

By the mid-2020s, when most well known automotive brands will have an established line up of EVs to choose from, battery raw materials could face a real supply crunch. Bloomberg estimated in a recent 2019 forecast that currently, EVs only make up 0.5% of the world’s vehicle fleet. However, as Montgomery predicted, “most automotive manufacturers plan to go completely electric by 2050.” For now, supplies of these three metals: cobalt, nickel and lithium, are enough to meet current demand. But short-term market prices of these metals remain stubbornly low, possibly deterring new producers from developing the greenfield projects to meet future demand, he added.

According to Gavin Montgomery, Research Director at Wood Mackenzie, Global electric car sales (with a plug) are forecast to continue rising, and by 2025, it is estimated that EVs will make up 7% of all passenger car sales and 38% by 2040.

Each EV battery, is made up of a complex cocktail of metals – the typical materials include cobalt, lithium, nickel amongst others. If we look at the cathode chemistry of a Tesla Model S, the battery is normally composed of 80% nickel, 15% cobalt and 5% aluminium. Samsung SDI, SK Innovation, LG Chem, Northvolt, Terra E, CATL are all the main EV battery suppliers in Europe. A number of these suppliers have started to seek innovative strategies to secure supply of raw materials, such as through investment in greenfield mining projects to bring new sources of raw materials directly into their supply chains.

From a nickel perspective, supply concerns for the EV market are compounded by the steady growth in the stainless-steel market, growing at around 4-5% year on year globally, and the Indonesian nickel export ban which was brought forward to January 2020.

In conclusion, with this rapid rise in demand for EV battery raw materials over the coming years as car producers ramp up the production of their EVs, and the price lows that may deter new investments in the sector, we may see sharp nickel price increases in the coming years, which will benefit existing and near-term nickel producers.

Sourcing: