Pt

Nickel is a key base metal for building sustainable societies due to its use in stainless steel and new battery technology. Its multiple physical and chemical properties make it essential in thousands of products from mobile phones to medical equipment and from wind turbines to batteries.

The nickel market is a US$20+ billion per year industry. Today’s market is dominated by stainless steel with over two thirds of total production used in its production. However, nickel is a critical component in new battery technology used in electric vehicles. This section of the market is forecast to grow significantly over the coming years, and will reshape the nickel industry over the coming decades.

According to the World Bank report “Minerals for Climate Action: The Mineral Intensity for the Clean Energy Transition” the production of minerals such as nickel and cobalt, could increase by nearly 500% by 2050, to meet the growing demand for clean energy technologies. As the world moves to realise a lower-carbon future there will be a substantial increase in demand for several key minerals and metals to manufacture cleaner energy technologies. The clean energy transition will be significantly mineral intensive - nickel intensive.

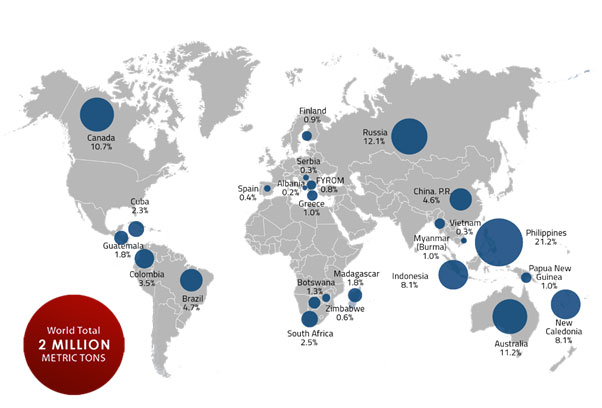

The world’s nickel resources are currently estimated at almost 300 million tonnes. Australia, Indonesia, South Africa, Russia and Canada account for more than 50% of the global nickel resources. Over two million tonnes of new or primary nickel are produced and used annually in the world, mined in more than 25 countries worldwide.

The Company believes there has been a significant under-investment in the sector and as a result there is a very limited pipeline of new projects due to come on line in the near term. Greenfield nickel projects take a 8-10 years to move from exploration through to production. Furthermore, research from UBS estimates only 26 of 41 advanced stage nickel projects deliver 15% IRR at long term nickel price of US$20k/t.

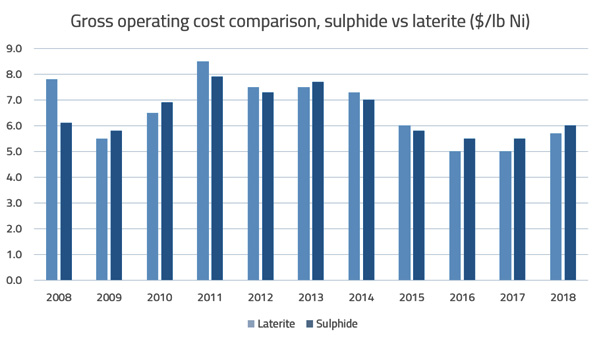

There are two main types of nickel ore deposits: sulphides and laterites. Many investors are of the view that sulphide deposits are easier to process (and therefore cheaper) as they require less energy to operate. Although nickel sulphide operations were historically cheaper on an operating cost basis, this is no longer the case. Over the past three years, nickel laterite operations have been cheaper to operate on average than nickel sulphide operations, and we expect that trend to continue.

Horizonte Minerals is uniquely position with two advanced stage, large, high-grade and scalable nickel projects that are 100% owned, providing investors with entry points into both the stainless steel and electric vehicle battery markets, providing investors with the potential for long term sustainable returns. Download our Investor Presentation to find out more on Horizonte’s investment opportunity.

The long-term consensus nickel price, according to data from CIBC is US$16,228/t.

The Stage 1 Base Case for Horizonte’s 100% owned Araguaia project’s Feasibility Study was US$14,000; however, based on the consensus long-term nickel price of $16,400, the project NPV is $691 million generating free cash flow of over US$2.9 billion, giving an IRR of 27%.

Investors can plug-in their own nickel price into our NPV calculator on the Araguaia project page.